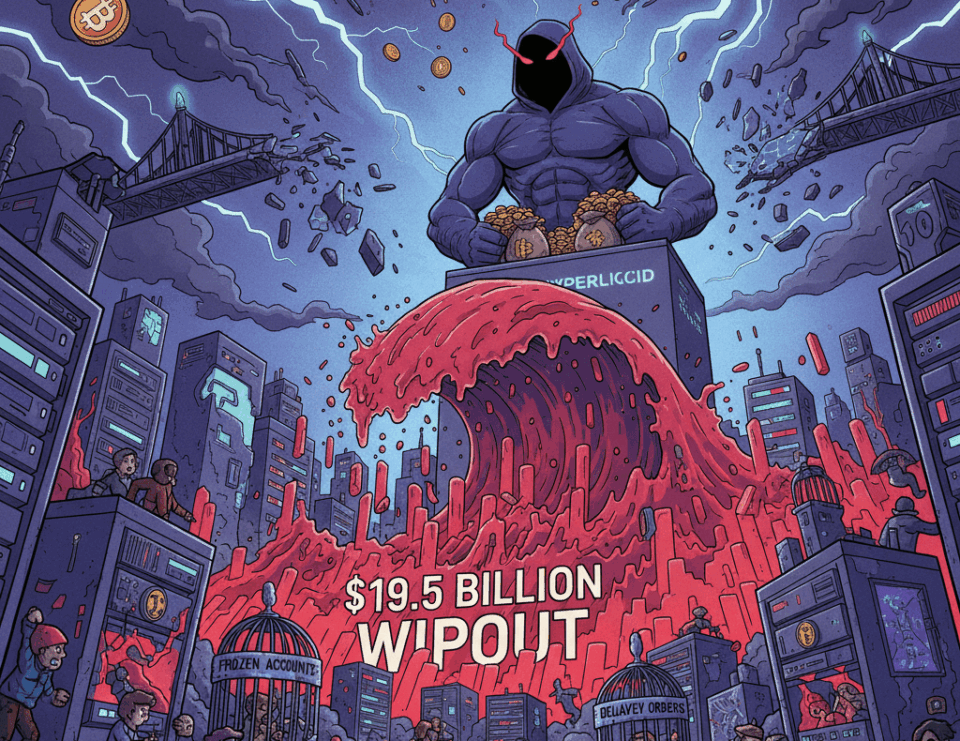

The crypto market experienced a major convulsion this past October 10th. A forced sell-off wiped out nearly $19.5 billion in leveraged positions within a matter of hours. According to industry reports like CCN, this massive liquidation exposes centralization risks by revealing critical liquidity and operational failures at major centralized exchanges, affecting millions of users.

The event was triggered by a sharp 8.4% drop in Bitcoin’s price from its $121,000 level, dragging the rest of the altcoins into double-digit losses. In total, the cascade of liquidations impacted approximately 1.6 million trading accounts. Furthermore, it temporarily erased about $560 billion from the total crypto market capitalization. The concentration of leverage on just a few platforms turned a dip sparked by geopolitical news into a systemic cascade. The limits of centralized exchanges became evident, with delayed order executions, frozen accounts, and opaque liquidation processes that compounded the damage.

Beyond the Price: Structural Flaws Come to Light

This collapse not only affected prices but also the critical infrastructure of the digital economy. The crisis revealed the fragility of certain ecosystem components. The integrity of oracles is key for automated smart contracts, and during the event, price feed errors were recorded that led to incorrect liquidations and temporary de-pegging of some stablecoins. This episode is a reminder of past vulnerabilities, such as a cross-chain bridge hack in 2024 that compromised $2.3 billion in USDC, highlighting persistent operational risks.

The impact on market confidence is significant. The massive losses and poor management by exchanges hinder the entry of institutional capital and the trust of retail investors. Likewise, the concentration of liquidity in a few order books facilitates “flash crashes.” This event also raised suspicions about information asymmetry, especially after it was revealed that a single “whale” on the Hyperliquid platform made profits between $190 and $200 million, intensifying pressure for greater controls and operational audits.

This episode of extreme volatility was not an isolated event. The way it unfolded serves as a decisive operational warning for the entire industry. Attention is now turning toward a potential regulatory response. Various jurisdictions are expected to prioritize the evaluation of custody practices, transparency in liquidation engines, and the standardization of oracles to prevent a similar event from recurring and to strengthen the market’s long-term resilience.