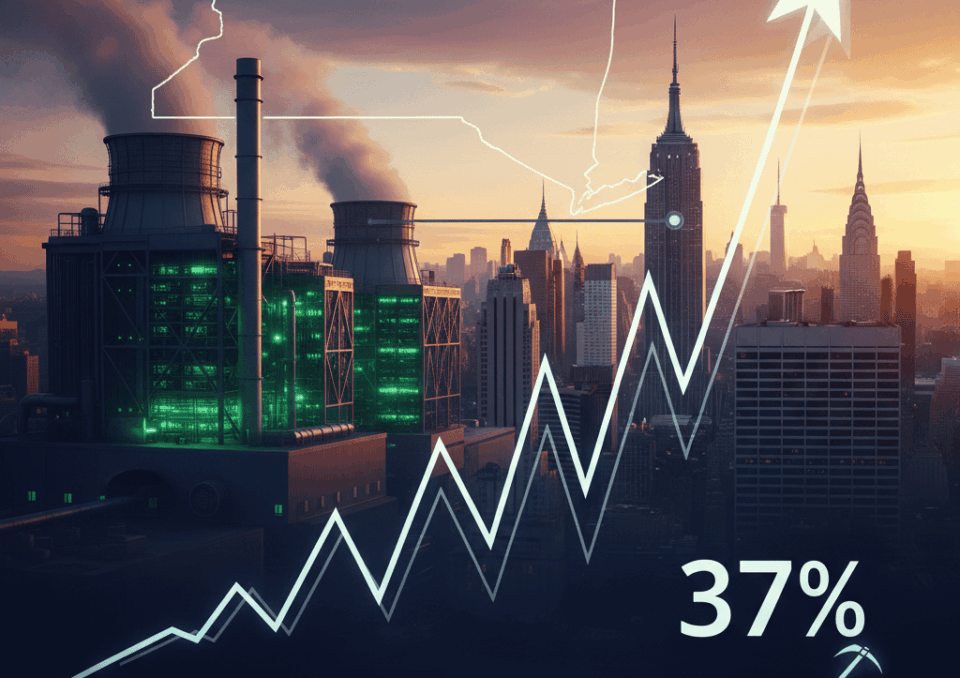

Bitcoin miner Greenidge announced a key agreement with New York state. The firm secured the renewal of its environmental permit for five years, boosting its stock (GREE) over 37% this Monday, November 10. This Greenidge mining agreement in New York ends a long legal battle with state regulators.

In exchange for the coveted air permit, Greenidge committed to a significant reduction in its emissions. The miner must reduce its permitted greenhouse gas emissions by 44% by 2030. This ambitious goal aligns closely with the state’s 2019 climate law. That law seeks a statewide 40% reduction from 1990 levels. Furthermore, the pact resolves all pending litigation. This includes the lawsuit Greenidge filed after the state denied it the same permit in 2022.

The New York State Department of Environmental Conservation (NYSDEC) had previously rejected the renewal. The agency cited the negative impact of mining operations on the environment three years ago. Greenidge operates a natural gas power plant in Dresden. This plant powers both its Bitcoin mining operations and the state’s power grid. The prolonged dispute has been a focal point in the debate over the energy impact of proof-of-work (PoW) mining in the state.

Can Bitcoin Mining Coexist with Ambitious Climate Goals?

The news was met with euphoria by the market. The stock (GREE) surged over 75% after Friday’s announcement in after-hours trading, before settling at a 37% gain on Monday. The deal was celebrated by local stakeholders. Roman Cefali, business manager of the IBEW Local Union 10, called it a “tough new permit deal.” He praised Governor Kathy Hochul for “protecting good-paying union jobs and achieving real, tangible environmental progress”. This pact sets a key precedent for other mining companies. It demonstrates that it is possible to operate in jurisdictions with strict climate regulations through negotiation and compromise.

This Greenidge mining agreement in New York marks a turning point in the tense relationship between the industry and regulators. It represents a significant victory for the company, which now has a clear operational roadmap for the next five years. However, the mining industry in New York still faces imminent regulatory challenges. Recently, local lawmakers introduced a bill. This bill seeks to tax PoW miners for their electricity consumption, allocating the funds to energy affordability programs. The debate over energy and mining in the state is far from over.