Australia’s financial regulator has issued a stark warning: the country risks falling behind. Blockchain-driven tokenization is reshaping global markets. The Australian Securities and Investments Commission (ASIC) urges swift action to modernize regulations and embrace innovation.

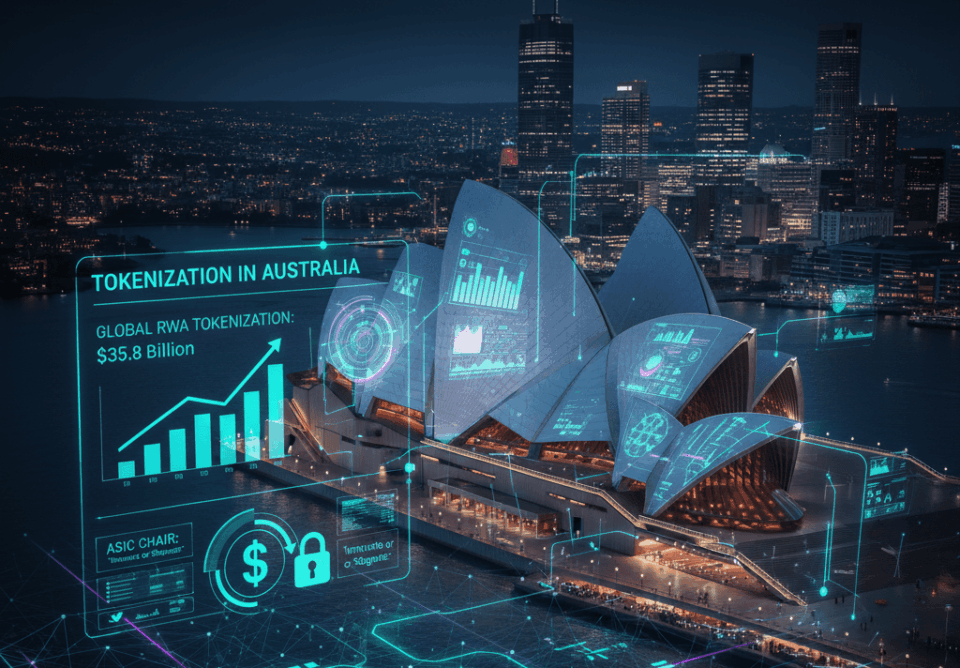

Speaking on November 5 at the National Press Club in Canberra, ASIC Chair Joe Longo emphasized that tokenization, the process of turning real-world assets into digital tokens, is transforming capital markets worldwide. Longo cautioned that unless Australia adapts, it could become a “land of missed opportunity.” “Australia must innovate or stagnate. Seize the opportunity or be left behind,” Longo stated.

Longo compared the coming wave of tokenization to past financial technology milestones, such as the introduction of electronic trading and the ASX’s CHESS system in 1994. He highlighted that distributed ledger technology (DLT) could “fundamentally transform our capital markets.” Tokenization allows for instant settlement, fractional ownership, and greater investor access. “J.P. Morgan has told me their money market funds will be entirely tokenized within two years,” he noted, adding that Nasdaq and the Depository Trust & Clearing Corporation (DTCC) are also developing tokenized trading and settlement platforms.

Can Australia Catch Up in the Global Tokenization Race?

Longo’s remarks come amid a global race to digitize traditional assets. Switzerland’s SIX Digital Exchange has already processed over $3 billion in digital bond issuances. Meanwhile, the UK is trialing a digital securities sandbox through the Bank of England and Financial Conduct Authority. In contrast, tokenization in Australia efforts remain in early stages, with pilot programs like Project Acacia, led by the Reserve Bank and the Digital Finance Cooperative Research Centre, exploring tokenized debt markets.

Globally, over $35.8 billion worth of real-world assets (RWAs) are now tokenized on-chain, according to data from RWA.xyz. The sector is dominated by private credit ($18.7 billion) and U.S. Treasury debt ($8.7 billion). This reflects institutional appetite for tokenized fixed-income products. According to the 2025 Skynet RWA Security Report, the market for tokenized real-world assets (RWA) could expand to $16 trillion by 2030. Tokenization’s growth is being driven by major financial players, from BlackRock and J.P. Morgan to DBS Bank, who are integrating blockchain infrastructure into traditional finance.

Longo’s concern is that while other nations are adapting regulatory frameworks to attract tokenized capital, Australia risks being sidelined by inaction. “Other countries are actively courting this capital,” he said. “If we fail to choose, the changes in our markets may not be for better.” Longo outlined ASIC’s plan to relaunch its Innovation Hub. This will support fintech and market infrastructure experiments, alongside renewed cooperation with international regulators. Longo concluded by urging collective action across government, regulators, and the private sector to build modern financial foundations.