TL;DR

- He Yi, Binance’s co-founder, spoke in Hong Kong about the urgent need to integrate the crypto industry with traditional finance to foster growth.

- The event, which brought together over 50 industry leaders, also explored new opportunities for institutional funding.

- Binance’s strategy emphasizes a user-focused approach, with an eye on regulated and sustainable innovation.

On April 8, 2025, at the Crypto Finance Forum in Hong Kong, Binance co-founder He Yi made it clear: the future of money is not division, but collaboration. Speaking before a global audience of over 50 top industry figures, Yi stated that as the crypto ecosystem matures, it must increasingly connect with traditional finance. Not as a compromise, but as a strategic evolution that respects the decentralized roots of crypto.

“He Yi didn’t just speak about innovation — she spoke about responsibility. True crypto evolution lies in understanding user needs and building solutions that give value back to the community,”

analysts present at the forum remarked.

Hong Kong: A Global Financial Testing Ground

It’s no coincidence the forum was held in Hong Kong. This Asian financial hub has long positioned itself as a bridge between regulatory tradition and crypto innovation. Its progressive stance has enabled companies like Binance to develop regulatory-compliant strategies without abandoning the core values of decentralization and user empowerment, which remain central to the crypto movement.

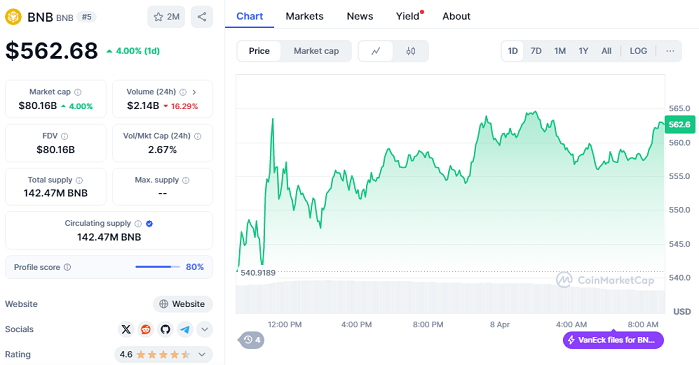

Currently, Binance Coin (BNB) is trading at $562.68, with a market capitalization of $80.16 billion, representing 3.16% of the global market. Its daily trading volume reached $2.14 billion, down 16.29%, while the price rose by 4% in the last 24 hours, despite a cumulative drop of 18.73% over the past 90 days.

Moreover, a lot of experts suggest that a well-managed regulatory opening could accelerate the launch of hybrid financial products, such as blockchain-enabled banking services, or global decentralized payment solutions. Dialogue between sectors is more dynamic than ever, and the next few years are shaping up to be decisive for this emerging ecosystem.

Regulation Is No Longer a Barrier, It’s a Gateway

According to many specialists, embracing flexible and collaborative regulatory models may be the catalyst that propels crypto to the next level. A harmonious relationship between governments, companies, and users could foster a safer, more reliable, and more open environment, one that welcomes institutional capital with confidence.

Rather than resisting regulation, the crypto sector appears to be learning how to play in the big leagues… and win.