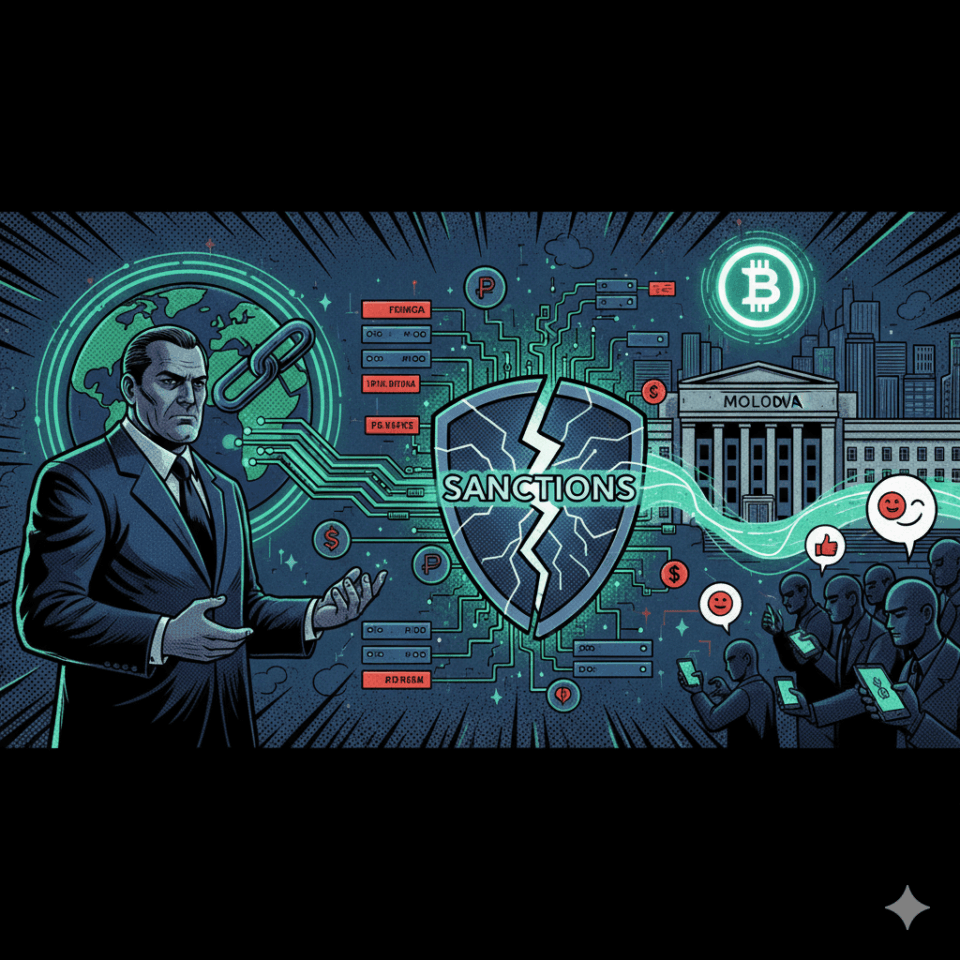

Leaked documents, analyzed by the blockchain analysis firm Elliptic, have unveiled a complex financial operation that used cryptocurrencies to move over $8 billion. This network was allegedly designed to circumvent sanctions on Russia and influence political processes in Moldova, directly linking back to fugitive oligarch Ilan Shor.

The investigation details how the network, named A7, facilitated a massive volume of stablecoin transactions over the last 18 months. The funds were funneled through various front companies, allowing Russian actors to access the global financial system. The operation even developed its own ruble-pegged stablecoin to reduce reliance on U.S.-issued assets and enhance its operational autonomy.

The analysis of internal documents confirms the use of sophisticated technology to obscure the origin and destination of the money. This infrastructure was not only used for evading sanctions on Russia but also for financing a political machine in Moldova, paying local activists through mobile applications and systems designed to manipulate public opinion.

This revelation is crucial because it offers compelling proof of how digital assets can be instrumentalized for large-scale illicit purposes. Unlike traditional finance, the cross-border nature of cryptocurrencies provides an escape route from restrictions imposed by Western governments, confirming regulators’ warnings about the risks associated with the sector.

For the cryptocurrency market, this case underscores the growing regulatory pressure faced by exchanges and service providers. The leak gives authorities new wallet addresses to monitor, which could trigger increased surveillance of transactions and heighten compliance requirements for platforms, impacting the operations of investors and companies alike.

The exposure of this financial network demonstrates the ongoing battle between technological innovation and regulatory efforts. As malicious actors find new ways to exploit the crypto ecosystem, control bodies are expected to intensify their oversight to prevent money laundering and the evasion of sanctions on Russia.