TL;DR

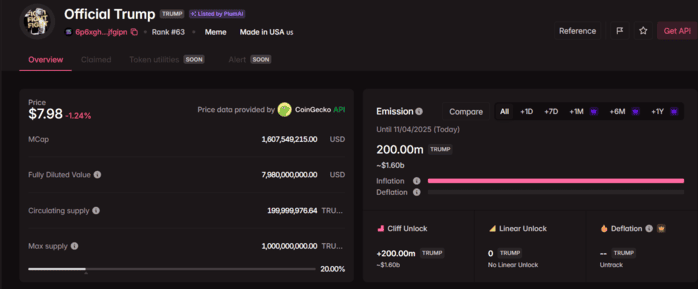

- The $TRUMP token peaked at $75.35 after its launch, but it’s currently trading at $8, reflecting an 83% drop.

- More than 800,000 wallets purchased the token, resulting in collective losses of nearly $2 billion since launch.

- On April 17, 40 million additional tokens will be unlocked—equivalent to 20% of the total supply—which could trigger another crash due to oversupply.

In January 2025, Donald Trump introduced a new project tied to the crypto world: a memecoin named after him, $TRUMP. The launch sparked strong initial interest. The token reached $75.35 in its first few weeks. However, that excitement quickly faded. It now trades at around $8, marking an 83% drop from its peak.

Over 800,000 wallets acquired the token. Collectively, users have lost close to $2 billion. The situation raises questions about the sustainability of projects like this, especially when they revolve around public figures. The initial appeal often relies more on a compelling narrative than on solid technical or economic fundamentals. This explains why some early investors managed to multiply their capital, while most were caught in a steep decline.

On April 17, a token unlock is scheduled that could worsen the situation. An additional 40 million $TRUMP tokens—valued at roughly $320 million—will be released. This amount represents approximately 20% of the total supply.

The $TRUMP Token Will Not Withstand the Volume and Will Drop Again

The companies holding these tokens, such as CIC Digital LLC and Fight Fight Fight LLC, have direct ties to Trump. If these tokens suddenly hit the market, the price impact could be severe. Current low liquidity means demand would not be strong enough to absorb that volume without another sharp drop.

The token’s behavior is a clear example of the risks of investing in projects whose structure relies more on marketing than real utility. The extraordinary gains some enjoyed early on were only possible in a highly speculative environment. As enthusiasm fades, the market adjusts prices based on supply, demand, and the asset’s credibility.

Attention is now focused on the unlock. The market has repeatedly shown sensitivity to such events. The outcome may reinforce the idea that memecoins linked to public figures act more as high-risk instruments than sustainable investment vehicles.