TL;DR

- The Arizona House of Representatives has approved bill SB 1373, which would allow the state to manage and leverage seized digital assets like Bitcoin, stablecoins, and NFTs.

- Now awaiting Governor Katie Hobbs’ decision, the bill could set a national precedent.

- It also allows the state to invest up to 10% of the fund annually, opening new revenue streams and solidifying Arizona’s role in the crypto revolution.

With 60 votes reviewed and only one final step before reaching the governor’s desk, SB 1373 has sparked debate and rising expectations across the crypto ecosystem. Introduced by Senator Mark Finchem, the legislation proposes creating a “Strategic Digital Asset Reserve Fund” managed by the state treasurer. This fund would consist of cryptocurrencies and other digital assets seized during criminal proceedings. The treasurer would be authorized to invest up to 10% of the fund annually and even lend part of it to boost returns, as long as financial risks remain contained.

Bitcoin, NFTs, and Stablecoins: Smart Diversification in State Reserves

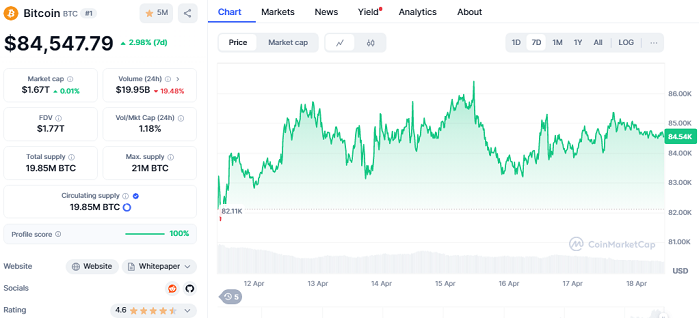

Unlike similar initiatives in states like Texas or New Hampshire, Arizona stands out by including not just Bitcoin but also stablecoins and non-fungible tokens (NFTs) in its legal framework. This broader approach reveals a more comprehensive understanding of the digital asset ecosystem and its impact on financial, technological, and cultural fronts. Currently, Bitcoin is trading at $84,547.79, with a market cap of $1.67 trillion. Despite a 19% drop over the last 90 days, it has shown a weekly recovery of 2.98%, reinforcing its long-term potential.

SB 1373 might also merge with another crypto-related bill, SB 1062, which aims to expand the definition of legal tender to include cryptocurrencies. At the same time, a separate initiative, SB 1025, is also progressing through Arizona’s legislature. That bill proposes allowing the state treasury and retirement system to invest up to 10% of available funds directly in Bitcoin, showing the state’s broader commitment to decentralized finance. With multiple bills converging, Arizona is signaling a major shift in how public institutions perceive and engage with digital assets.

Financial Innovation: Arizona Emerges as Crypto Pioneer

Although Governor Hobbs has vetoed numerous recent bills for unrelated budgetary reasons, pressure from legislators and the growing adoption of digital assets could tip the scales in favor of SB 1373. This law represents a decisive step toward integrating blockchain technologies into state financial management, giving Arizona a competitive advantage over other states. If passed, it will usher in a new era where digital assets are an active part of the public economic system.