TL;DR

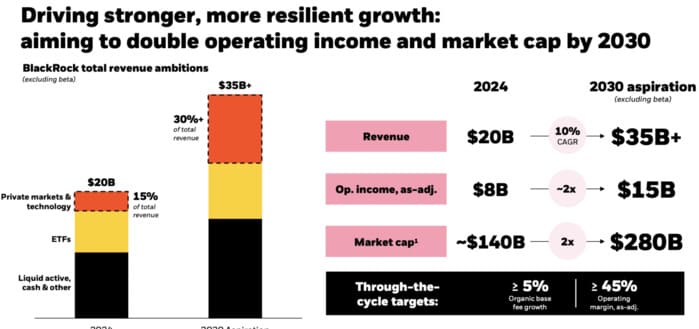

- BlackRock projects over $35,000 million in revenue and $15,000 million in operating profit by 2030, with a market capitalization of $280,000 million.

- It expects to raise $400,000 million in private markets and generate an extra $1,000 million in revenue if its clients increase their allocation to private assets by just 5%.

- IBIT, its bitcoin fund, has surpassed $70,000 million, and BUIDL now controls 40% of the U.S. tokenized bond market.

BlackRock has outlined an ambitious plan to double both its operating profitability and market capitalization by 2030. The firm aims to generate more than $35,000 million in revenue and around $15,000 million in operating profits, pushing its market value to approximately $280,000 million.

The roadmap relies on sustained organic growth, supported and enhanced by acquisitions that strengthen and broaden its footprint in private markets, technology, ETFs, and full portfolio solutions.

BlackRock’s chief financial officer explained that the firm maintains a baseline growth rate close to 5% annually, even under adverse conditions. It currently manages $11.6 trillion in assets and plans to raise $400,000 million in private markets before 2030. Additionally, the closing of its acquisition of HPS Investment Partners will reinforce its private credit franchise. These moves follow recent takeovers of Global Infrastructure Partners and Preqin, improving its offerings in infrastructure, private credit, and data intelligence.

The executive team estimates that just a 5% increase in private asset allocation from existing clients would represent an opportunity to manage over $150,000 million in new assets and generate more than $1,000 million in recurring revenue. Alongside this, BlackRock is creating four new business lines, each with the potential to generate at least $500 million annually.

BlackRock Dominates Crypto ETF and Tokenized Fund Markets

At the same time, BlackRock is moving aggressively in the crypto market. It has integrated Aladdin, its technology platform, with networks like Coinbase and built strategic partnerships with stablecoin issuers such as Circle. The firm is also driving institutional BTC and ETH products through ETPs. Its bitcoin fund, IBIT, has reached $70,000 million in assets, becoming the fastest-growing ETF in history.

Another priority is the development of tokenized funds, led by its BUIDL fund, which now manages more than $3,000 million. These products combine blockchain efficiency with the stability of traditional markets, attracting new investors from outside the conventional financial system.

BUIDL grew by $1,000 million between March and June 2025, fueled by a $1,300 million contribution from Ethena Labs via its USDtb stablecoin. This positioned the fund with a 40% share of the U.S. tokenized bond market, estimated at $7,300 million