TL;DR

- Arizona Governor Katie Hobbs vetoed House Bill 2324, stopping the creation of a state-managed digital asset fund.

- The bill aimed to allocate confiscated digital assets like Bitcoin to both law enforcement and state reserves.

- Despite growing crypto adoption across the U.S., Arizona remains one of the few states actively rejecting integration of digital assets into state financial structures.

On July 1, 2025, Arizona Governor Katie Hobbs vetoed House Bill 2324, effectively halting the creation of a Digital Assets Reserve Fund that would have stored Bitcoin and other cryptocurrencies seized through criminal forfeiture. The bill proposed allocating the first $300,000 of such seized assets to the Attorney General’s office, with remaining funds split between the new reserve and other state uses.

This marks the third digital asset-related bill vetoed during the current legislative session, reinforcing Hobbs’ consistent opposition to state-run crypto asset programs. In her statement, she criticized the bill for discouraging local law enforcement from collaborating with the state, as it would strip them of control over seized digital assets. Critics argue this stance slows progress toward modernizing Arizona’s financial infrastructure and limits potential benefits for public safety funding and community programs.

Crypto Growth Clashes With State Skepticism

While digital assets continue gaining traction in U.S. state governance, Arizona’s hesitation signals a different path. The state’s refusal to formalize crypto asset reserves places it among a shrinking group of jurisdictions resisting blockchain integration at the government level.

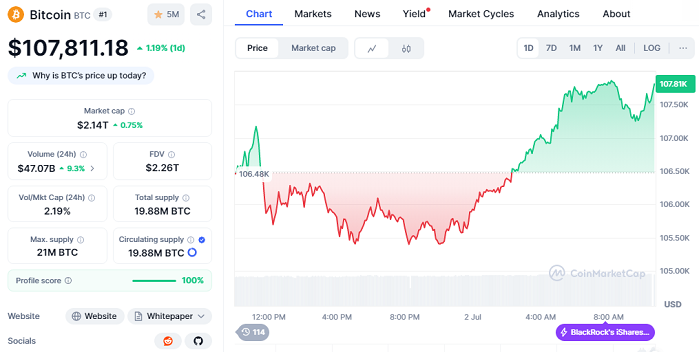

Despite this decision, market response has remained minimal. Bitcoin (BTC) is currently trading at $107,811.18, up 1.19% in the last 24 hours, with a total market capitalization of $2.14 trillion. The asset holds a market dominance of nearly 65% as of July 2, according to CoinMarketCap. Ethereum and other major assets have shown no notable volatility in reaction to the veto.

Arizona’s rejection comes as other states experiment with integrating blockchain into public finance. States like Wyoming and Texas have already taken bold steps to regulate and even hold crypto as part of their public treasuries. Hobbs’ decision, however, may discourage similar efforts in states where local and state enforcement interests are not aligned.

Analysts suggest that unless Arizona reconciles internal policy goals with crypto developments, it risks falling behind in regulatory innovation. Meanwhile, the broader crypto market continues its upward momentum, driven by macroeconomic shifts, institutional inflows, and regulatory clarity in more crypto-forward states, which could ultimately gain a long-term economic edge and stronger influence.