TL;DR

- U.S. Bitcoin ETFs added nearly 11,000 BTC in two days despite the dip below $116,000, with no significant outflows recorded.

- Unlike in February, when a sharper drop triggered mass sell-offs, funds held their positions and increased their purchases, according to Glassnode.

- Timothy Peterson projects a price of up to $135,000 within six months if the ETF-driven supply deficit continues.

Capital inflows into U.S. Bitcoin ETFs increased despite the recent market correction.

Although BTC briefly dipped below $116,000, institutional funds accumulated nearly 11,000 BTC in just two days. On Monday, 7,500 BTC were added, followed by another 3,400 BTC on Tuesday, with no notable outflows from any fund.

Monday saw one of the largest daily inflows to US spot #Bitcoin ETFs in the past 3 months (+7.5K $BTC). But what stands out is Tuesday’s response: institutions didn’t flinch – they doubled down, adding another +3.4K $BTC. Outflows remained near zero across the board. pic.twitter.com/PO1vaffWqH

— glassnode (@glassnode) July 16, 2025

The data was published by Glassnode, which emphasized a shift in behavior compared to previous episodes of volatility. Unlike in February—when a deeper drop triggered $3.2 billion in outflows over eight trading sessions—ETFs this time held firm and even expanded their positions.

Bitcoin Could Reach $135K in the Coming Months

The contrast points to a strategic change among large investors. Instead of reacting with quick sales, institutions used the dip as an opportunity to increase their holdings. This shift underscores the role of spot ETFs as structural demand drivers in the Bitcoin market, especially during retracements.

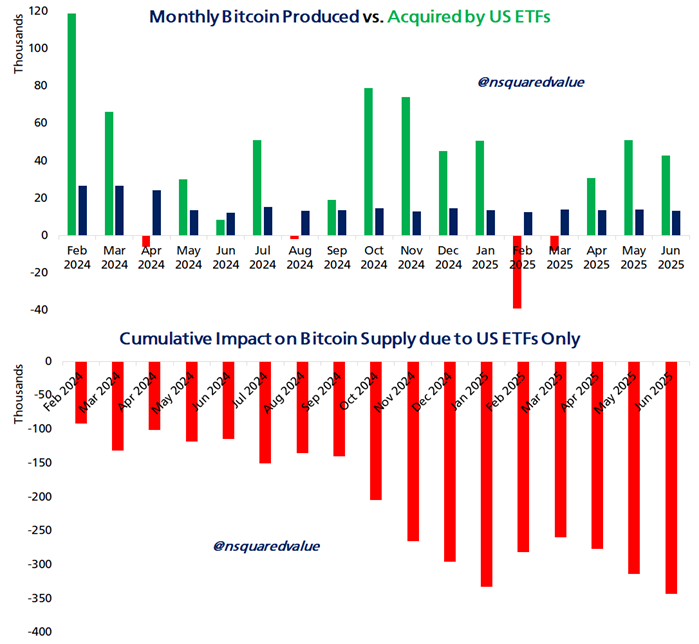

Economist Timothy Peterson estimated that ETFs are buying Bitcoin faster than the network can produce it. According to his analysis, the cumulative deficit from institutional purchases has reached 343,000 BTC, equivalent to around $40 billion at current prices.

If this pace continues and no new sources of supply—such as miner sales or long-term holders—enter the market, the price could rise to between $130,000 and $135,000 within the next six months. His forecast assumes steady demand and a stable market environment.

Bitcoin currently trades around $119,000, still below the all-time high reached days ago, but with a more solid institutional support structure than in previous cycles. The speed and scale of the recent ETF purchases reinforce the idea that these funds intensify bull market trends.