TL;DR

- Bitcoin’s surge past $120,827.27 reflects growing investor demand for assets that can withstand the impact of the United States’ swelling deficit, now facing a potential $7 trillion swing.

- Analysts point to upcoming crypto-focused legislation and the Federal Reserve’s expected rate cut as additional drivers.

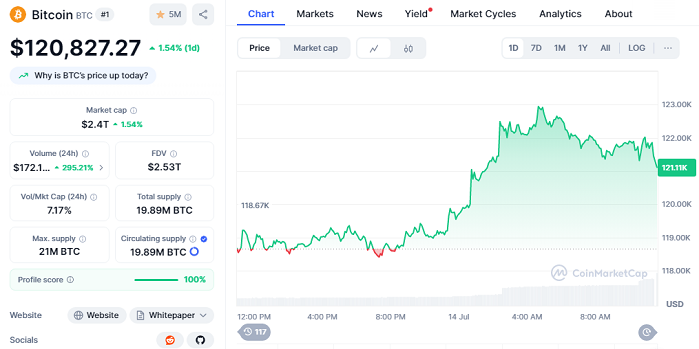

- With a 24-hour gain of 1.54% and a market cap near $2.4 trillion, Bitcoin’s status as a macro hedge deepens.

While Bitcoin was once described as a technological breakthrough for peer-to-peer payments, today it stands shoulder to shoulder with gold as a shield for investors wary of the United States’ unchecked fiscal direction. Markus Thielen, head of research at 10x, emphasizes that the shift is not about blockchain experiments but about protecting capital from a ballooning federal deficit that could add trillions more than originally projected.

After Donald Trump’s “One Big Beautiful Bill Act” lifted the debt ceiling by an unprecedented $5 trillion, markets are now bracing for the actual impact, which could see deficits expand by up to $7 trillion instead of shrinking by the promised $2 trillion. This backdrop has pushed many investors to treat Bitcoin as a macro safe haven rather than just a speculative bet.

With the asset now holding firmly above $120,827.27 (1.54%), its role in diversified institutional portfolios appears to be maturing. Rachael Lucas, an analyst with BTC Markets, points out that breaching the $120,000 threshold signals deeper integration of crypto into mainstream financial strategies.

New Legislation Eyes Crypto Regulation

Washington D.C. is about to host “Crypto Week,” during which lawmakers will tackle bills like the CLARITY Act, which targets market oversight, and the GENIUS Act, focused on stablecoin rules. There’s also speculation around the Anti-CBDC Surveillance State Act and a policy report from Trump’s Digital Asset Task Force, which could introduce a Strategic Bitcoin Reserve as early as July 22.

Federal Reserve Moves Shape Bitcoin Outlook

Investors are also watching the Federal Reserve’s upcoming July 30 meeting. While rate cuts are expected, futures markets still see a high probability that rates stay unchanged. If monetary policy turns more accommodative, Bitcoin could see another leg up. Eugene Cheung of OSL predicts the asset might push toward $150,000 by year’s end, underlining its new role as a hedge that thrives when traditional policies appear overstretched.

As fiscal uncertainty in the US deepens, Bitcoin’s steady climb and robust $2.4 trillion market cap send a clear signal: digital assets are not just surviving, they’re positioning themselves as a cornerstone for investors navigating an era of record spending and policy shifts.