TL;DR

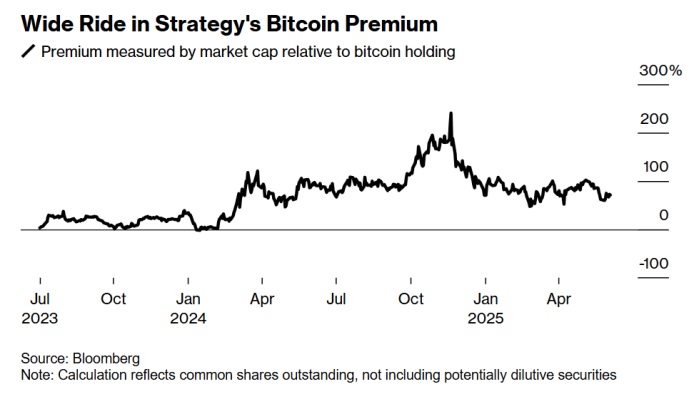

- Jim Chanos believes Strategy’s premium over its Bitcoin holdings is unsustainable and suggests exploiting the arbitrage opportunity.

- Hedge funds are taking advantage of a low 0.3% fee and limited short interest to maintain positions against Strategy’s stock.

- Analysts warn that mergers or corporate strategy shifts could disrupt the valuation and complicate short-term arbitrage plays.

Jim Chanos, famous for predicting Enron’s collapse, has made a new market-shaking forecast.

A Bold Chanos Takes Aim at Bitcoin’s Corporate Giant

The investor recommends buying Bitcoin and shorting Strategy, the firm run by Michael Saylor that holds billions in BTC. His case centers on the gap between the company’s stock market value and the actual value of the Bitcoin it owns. Although that spread exceeded 200% in 2024, it currently sits around 70%, still leaving room for an arbitrage play.

Strategy has maintained that premium through a treasury model that involves issuing shares and debt to purchase Bitcoin. This approach has attracted retail investors drawn by indirect exposure to crypto, no management fees, and the potential to increase Bitcoin per share through leverage. However, for Chanos, paying $400 for a share representing $220,000 worth of Bitcoin — when the asset trades at $110,000 — makes no sense.

Watching for Unexpected Shifts

Hedge funds and arbitrage firms have been closely tracking this mismatch. Some liken it to the arbitrage opportunity once seen between Bitcoin and the Grayscale Bitcoin Trust in 2021, though with greater operational flexibility. The costs to maintain short positions in Strategy remain low, with a 0.3% fee and only 11% of the float sold short, making it possible to hold these bets without logistical headaches.

Even so, the market can’t overlook the risks. Corporate events like mergers or shifts in the company’s core business could distort the relationship between the stock price and its Bitcoin holdings, complicating the trade. A surge in demand for stock loans to fuel arbitrage strategies could also raise borrowing costs for those shorting the stock.

Some analysts argue that Strategy’s premium is justified by its fee-free model and leverage capacity. Others side with Chanos, believing that advantage is flimsy. The consensus is that, within four to five years, the spread will likely close. While this kind of trade appeals to professional funds. Retail investors might find the volatility and risk of shifting market conditions too steep a price