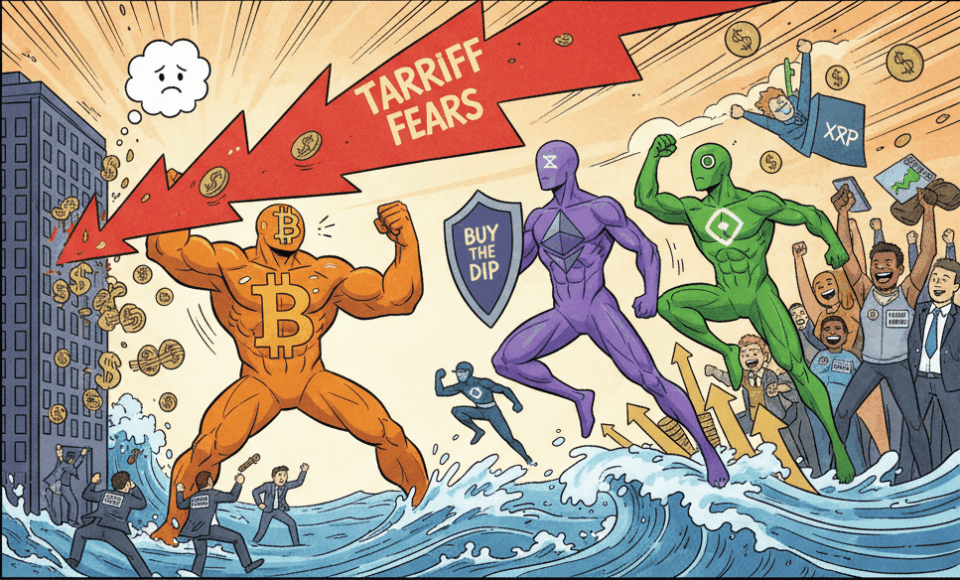

Bitcoin funds suffered a historic outflow of $946 million last week. The drop was triggered by tariff threats on October 10. However, investors are rotating towards Ethereum and Solana in a clear “buy the dip” move, according to the latest report from digital asset manager CoinShares.

The bleeding was almost entirely concentrated in Bitcoin. The crash is linked to Donald Trump’s tariff threat on Chinese goods. The affected funds were primarily those listed in the United States. James Butterfill, Head of Research at CoinShares, noted this stark geographical divide. While the US withdrew funds, European and Canadian investors bought the dip. Germany, Switzerland, and Canada registered net inflows. Trading volumes remained high. They reached $51 billion last week, nearly double the annual average.

Is This the Start of a Rotation into Altcoins?

This asset divergence is significant. It shows “buy the dip” behavior from investors outside the U.S. Butterfill specifically highlighted that Ethereum investors bought aggressively during the dip. Ethereum funds attracted net inflows of $205 million. Interest in altcoins was also boosted by new products. The launch of Solana and XRP options on the CME generated enthusiasm.

Exchange-traded products (ETPs) linked to Solana (SOL) and XRP had a stellar debut. SOL attracted $156 million and XRP $93.9 million in initial deposits. Butterfill also noted that the October 10th crash was less severe in ETPs. It happened after the markets had closed, which shielded those products from on-chain liquidations.

The market is showing a clear split. U.S. investors are reacting cautiously to geopolitical news. In contrast, other markets view downturns as buying opportunities, especially in altcoins. The coming weeks will be key. Observers will watch if this capital rotation from Bitcoin to Ethereum and Solana solidifies as a new trend in the digital economy.