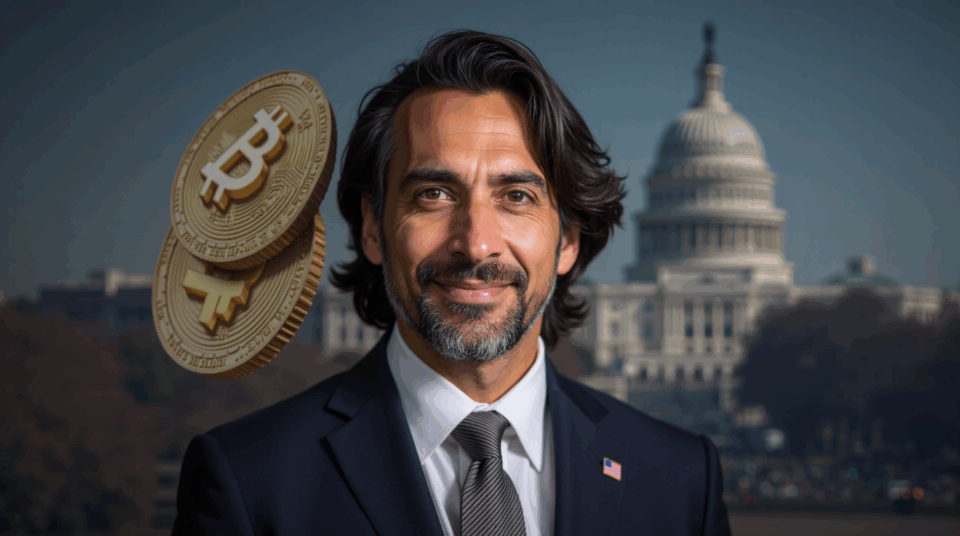

Ian Calderon announced his 2026 run for California governor and pledged to make the state the dominant U.S. hub for Bitcoin. His platform rests on three moves: declare Bitcoin legal tender, accept it for taxes, fees and state services, and park BTC on the public balance sheet. Supporters in the crypto industry cheer the plan, while budget officers, lawyers and watchdogs flag fresh questions.

The core of the platform proposes declaring Bitcoin legal tender, accepting it for the payment of taxes, fees and state services and recording BTC on the public balance sheet. The bet places the cryptoasset at the center of the agenda, not at the margin.

The plan goes beyond enabling digital payments: it seeks to weave Bitcoin into the state’s everyday finances. While the crypto sector celebrates, questions arise about price volatility, custody rules and the electorate’s tolerance.

The core of Ian Calderon campaign

Accounting treats Bitcoin as an intangible asset; marks-to-market flow through net equity and can alter the reported surplus or deficit. State-level adoption collides with uncertain federal rules, forcing treasurers and custodians to map compliance paths that do not yet exist. Until that regulatory map is clarified, implementation faces practical barriers.

Calderon must convince taxpayers that there are safeguards behind the promise; otherwise, the proposal stalls. Payments and reserves need cold storage vaults, KYC/AML filters and multi-sig key management, an operational job that custodians must provide beyond campaign slogans.

The 2026 election will decide whether Calderon receives the power to turn the idea into law. The campaign still owes voters a complete rule book and a risk-mitigation plan to back the promise.