TL;DR

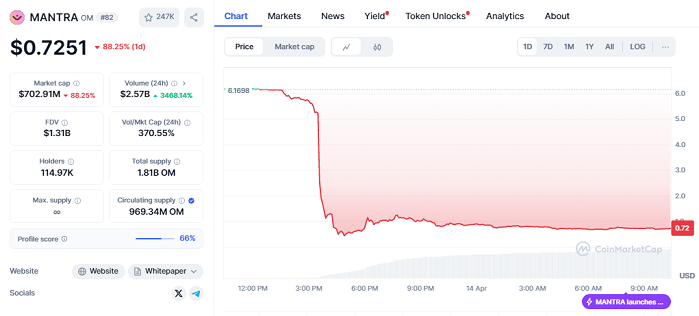

- Mantra’s OM token plunged over 88% in a few hours, triggering panic across the crypto ecosystem.

- The team attributed the collapse to forced liquidations during a low-liquidity window, firmly denying any rug pull or internal token dump.

- Despite the setback, Mantra remains a key player in the real-world asset (RWA) tokenization space, an emerging sector still facing structural challenges.

In one of the most dramatic crashes of the year, Mantra’s OM token plummeted from nearly $6 to just $0.37 within minutes, before stabilizing around $0.72. According to CoinMarketCap data, the drop occurred during a low-liquidity trading period, intensifying the impact of the liquidations. John Patrick Mullin, Mantra’s co-founder, stated on X that positions were closed without margin calls or warnings, suggesting that exchange mechanisms triggered the cascade.

Mantra, a protocol focused on the tokenization of real-world assets and built with the Cosmos SDK, emphasized that its token allocations remain locked and fully verifiable on-chain. The team strongly denied any internal manipulation or advance selling, rejecting any accusation of a rug pull. Additionally, on April 2, blockchain data from Arkham Intelligence showed that over 21 million OM tokens were burned, reinforcing the project’s long-term commitment to sustainability and tokenomics integrity.

For DeFi advocates, events like this highlight the importance of platforms with greater transparency, where users maintain more control over their assets. The crash also brings renewed scrutiny to how centralized exchanges operate during thin liquidity hours, especially when dealing with tokens linked to projects aiming for institutional adoption. Confidence is built on clarity and consistent protocol behavior.

The sudden and steep drop has reignited debate within the crypto community over how leverage and automation are handled by exchanges. Some analysts argue for stronger circuit breakers and decentralized risk controls.

RWA Tokenization at Risk or Natural Evolution

Though the incident dealt a serious blow, it also underscores the critical juncture at which the tokenized asset industry stands. Mantra, with high-profile partnerships like Google Cloud and Dubai’s DAMAC Group, now finds itself at a crossroads: rebuild investor trust or risk losing ground in the rapidly evolving RWA sector.

Experts like Hank Huang from Kronos Research view this crisis as a chance to improve the infrastructure of the ecosystem. Decentralization, transparency, and oversight in liquidation mechanisms must be strengthened if real-world assets are to be safely transitioned into the digital realm.

The OM episode isn’t the end—rather, it serves as a reminder that the road to mass adoption still requires refinement, vigilance, and, above all, resilience.