The American petroleum Institute reports that for the week stocks declined 46 thousand barrels. Even despite the fact that on Thursday the organization reported an increase to almost 7 billion, a Small reduction was enough to give oil to grow. However, oil still captures the losses for the third consecutive week.

“We expected more growth stocks, so even a small decrease contributed to the reduction of pressure on the market. At the moment its cost depends on many factors, and not just from the main” — says Brian Kessens, one of the leaders of the commodity Fund valued at $16 billion.

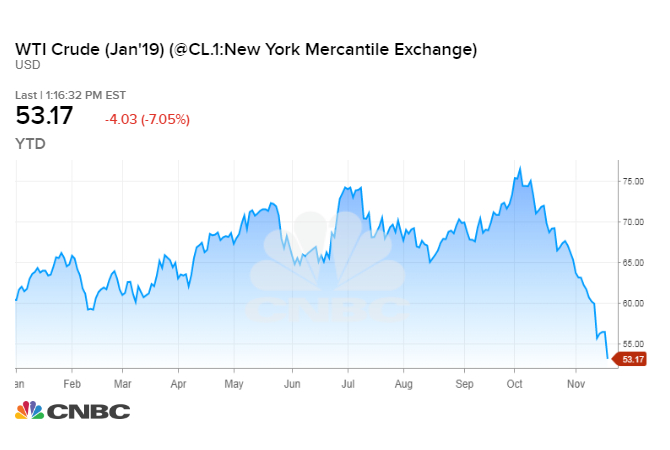

Oil and the stock market during this week have experienced a huge volatility. This is due primarily to uncertainty about the future of the world economy, which only exacerbates Washington’s policy. The outgoing quarter threatens to become the worst oil for 2014 not just for world economy, but also due to the efficiency of the entire agreement about OPEC cuts.

WTI futures for February rose by 72 cents and is now worth $45,33 per barrel. Total trading volume was 18% below 100-day average. This week, the contract fell 0.6 percent.

February futures for Brent rose 4 cents to $52,20 per barrel. More active in terms of volume of trading, the contract for March added 48 cents, worth $53,21.