TL;DR

- China has suspended economic stimulus measures, affecting global financial markets, especially the crypto industry.

- QCP Capital anticipates a capital reallocation towards cryptocurrencies, considering that the fading rally in the Chinese market could benefit Bitcoin and other digital assets.

- Despite the instability in the stock market and a decline in Bitcoin’s price, cryptocurrencies show resilience with an implied volatility stable around 43%.

China’s recent decision to suspend new economic stimulus measures has had a strong impact on global financial markets, particularly in the crypto industry.

Despite the instability this has caused in stocks, analysts from trading firm QCP Capital anticipate that this change could result in a capital reallocation towards crypto assets, offering a growth opportunity for Bitcoin and other cryptocurrencies.

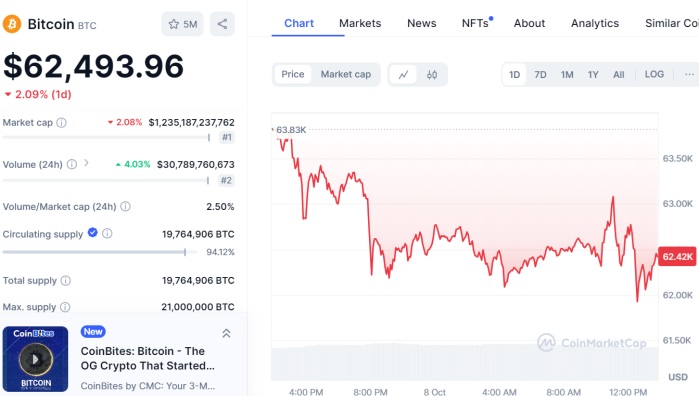

QCP Capital highlighted that, although the pause in economic stimulus has led to a decline in Bitcoin’s value, which currently trades near $62,500, the fading rally in the Chinese market could stimulate investment in cryptocurrencies. In particular, the firm expects capital to return to the crypto sector, recognizing its maturity as a viable investment alternative in risk environments.

The Crypto Market Shows Its Resilience

The MSCI Asia Pacific index experienced its largest monthly drop due to the lack of fiscal support, and the U.S. stock market was also dragged down by the negative trend. Shares of large tech companies suffered significant losses, raising the volatility index (VIX) to 22 points, an indicator of increasing market uncertainty. This situation has led investors to adopt a more cautious approach, especially in light of the upcoming earnings reports and consumer price index (CPI) data on the horizon.

However, despite the decline in the stock market, cryptocurrencies have shown clear resilience. The implied volatility in the crypto market has remained at relatively stable levels, averaging 43%.

This indicates strong confidence from investors in the market’s upside potential. Resilience is especially relevant given that some investors in China have been selling USDT to finance their stock purchases, without this significantly affecting Bitcoin’s price.

Although the end of stimulus measures by China has created an environment of uncertainty in the stock markets, projections for cryptocurrencies are more optimistic. It is expected that the reallocation of capital towards cryptocurrencies, combined with their growing acceptance as an investment alternative, will drive a new growth cycle in the crypto sector in the short to medium term