Tether, the issuer of the USDT stablecoin, has consolidated its dominance in the cryptocurrency market by reaching an impressive 71% share in 2023, raising its market capitalization to a staggering record of $95 billion in January 2024.

However, this explosive growth is overshadowed by a United Nations report linking USDT to an increase in cybercrime and money laundering in Southeast Asia.

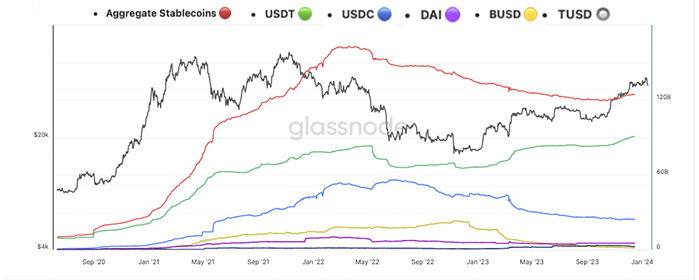

Glassnode data paints a compelling picture of Tether’s rise.

Its market capitalization hit a record $95 billion in January 2024, driven by a 40% increase in USDT supply over the past year.

Meanwhile, competitors like Circle’s USDC saw their market share decline, with USDT now commanding more than 7 times the circulation of its closest rival.

Paolo Ardoino, Tether ‘s new CEO, has prioritized cooperation with US law enforcement

The company boasts of freezing wallets linked to sanctions lists and recovering more than $435 million in illicit funds.

However, a ONU report casts a shadow over these efforts, detailing how USDT facilitates scams such as “sextortion,” “pig slaughter” scams, and underground banking in Asia.

Even though Tether has proactively banned more than 1,260 addresses linked to criminal activities, the volume of illicit transactions raises concerns about the effectiveness of these measures.

Critics point to Tether’s opaque backup reserves as fertile ground for misuse, demanding greater transparency to combat money laundering.

Tether domain faces regulatory challenges.

Although considered a bridge between traditional finance and the crypto world, USDT’s association with criminal activities threatens to erode trust and trigger stricter regulations.

Meanwhile, Circle’s recent Initial Public Offering (IPO) filing has added a new layer of complexity to the stablecoin landscape.

Circle, a direct competitor of Tether, has begun the process to go public, signaling a strategic move and a possible alteration in market dynamics.

With regulatory scrutiny intensifying, Tether’s future depends on its ability to address transparency concerns and combat illicit activities.

The question that remains is whether Tether will be able to clean up its image and maintain its dominant position, or if this will be the tipping point for a stablecoin revolution that will reshape the future of cryptocurrencies.

As regulators turn their attention and competitors like Circle come into play, Tether’s fate is at the crossroads, marking the start of an intense fight over the future of stablecoins.