TL;DR

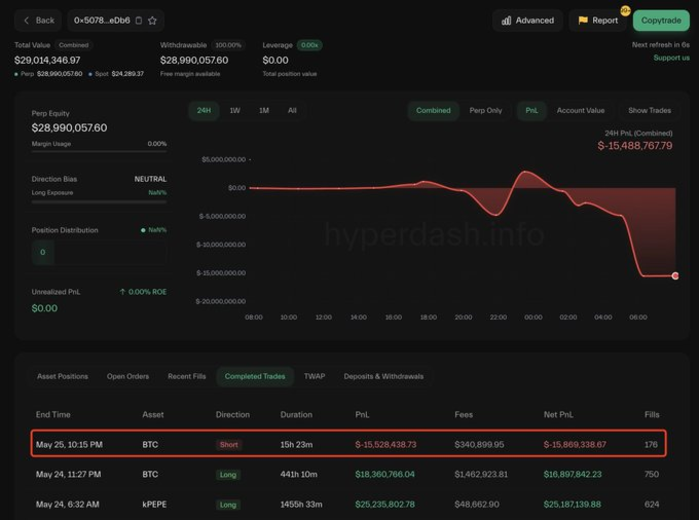

- James Wynn lost $15.86 million in less than a day after closing a $1 billion short position on Bitcoin using 40x leverage.

- The trade was executed on Hyperliquid, where Wynn risked his entire $50 million wallet and paid nearly $941,000 in fees.

- Despite the setback, he holds a net profit of $25.2 million after 38 trades in 75 days, with a total volume exceeding $2 billion.

James Wynn, one of the most active traders in the crypto market, made headlines after taking one of the largest single-operation losses in recent hours.

The trader closed a $1 billion short position on Bitcoin, which cost him $15.86 million in less than a day. The transaction was executed on Hyperliquid, a decentralized platform where Wynn had already carried out several high-risk trades in recent months.

The position, taken with 40x leverage, required him to use his entire $50 million wallet as margin. He entered the trade at an average price of $107,077 per Bitcoin, with a liquidation level set if the price climbed above $110,446. Beyond the direct $15.53 million loss, he also paid nearly $941,000 in fees.

This setback came in sharp contrast to the gains he secured just days earlier. Shortly before this failed short, he closed a long position in PEPE that earned him $25.19 million. A few weeks before that, he made $18.36 million on a long Bitcoin trade. Over the past 75 days, he executed 38 trades on Hyperliquid, with a 45% win rate and a total volume exceeding $2 billion.

James Wynn Holds a Net Profit of $25.2 Million

Despite the recent loss, Wynn’s overall results remain positive. Since he started trading on Hyperliquid, he has withdrawn $28 million in USDC and maintains a net profit of $25.2 million after deducting all fees and losses from losing trades. Over that same period, he paid $2.31 million in fees, reflecting both the frequency and size of his trades.

Even though he still holds a cumulative profit, the market’s volatility and aggressive use of leverage continue to trigger multimillion-dollar losses within extremely short timeframes. So far this year, no other on-chain trade had reached such volume or risked an entire wallet on a single position.