TL;DR

- Bitcoin dropped below $109,000, triggering over $185 million in leveraged long liquidations.

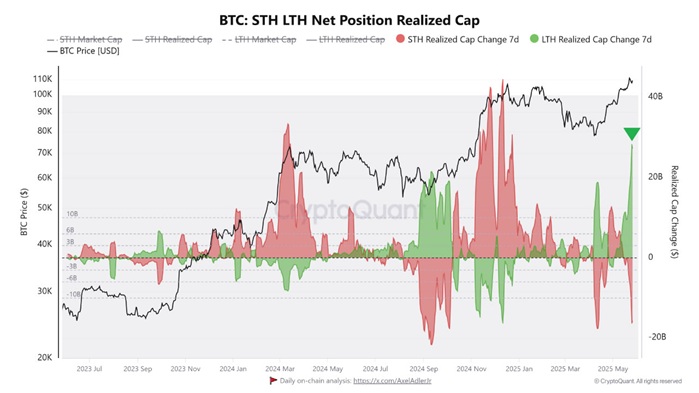

- Long-term holders took advantage of the forced selling to accumulate, pushing their realized cap above $28 billion.

- A double-bottom pattern suggests that if the current support holds, BTC could rebound to levels above $112,000.

The Bitcoin (BTC) market faced a wave of sharp liquidations this week that rattled leveraged speculators and opened up new opportunities for long-term investors.

BTC slipped below $111,000, sparking an initial wave of forced selling that wiped out over $97 million in long positions. Hours later, after breaking through the $109,000 support, a second liquidation round cleared out another $88 million.

The drops were driven by excessive leverage but didn’t impact all investors equally. While short-term traders endured cascading liquidations, Bitcoin holders with long-term strategies used this correction to increase their exposure. Data from CryptoQuant shows these investors’ realized cap rose above $28 billion — a level not seen since April.

Bitcoin Could Rebound and Break Above $112,000 in the Short Term

Analyst Amr Taha explained that this kind of accumulation during periods of financial stress reflects strong conviction. Instead of exiting their positions in response to volatility, long-term investors viewed these liquidation-driven dips as an opportunity to strengthen their holdings.

On the technical side, Ibrahim Cosar identified a double-bottom pattern on Bitcoin’s charts — a formation that typically signals a potential trend reversal if prices manage to hold above current support levels. Based on his estimate, if this support zone holds, Bitcoin could recover and climb past $112,000 in the short term.

For now, BTC has failed to maintain the $110,000 mark, testing that level twice unsuccessfully before the liquidations hit. Most of the forced positions were liquidated on Binance, where high leverage magnified the losses.

The contrasting behavior between short- and long-term market players highlights their different approaches when faced with extreme volatility. While some were forced out, others seized the moment to consolidate their positions