The cryptocurrency market is colored green after side trading at the start of yesterday. According to CoinMarketCap, almost all 20 coins from the top show a slight increase.

Coin360 Market Visualization

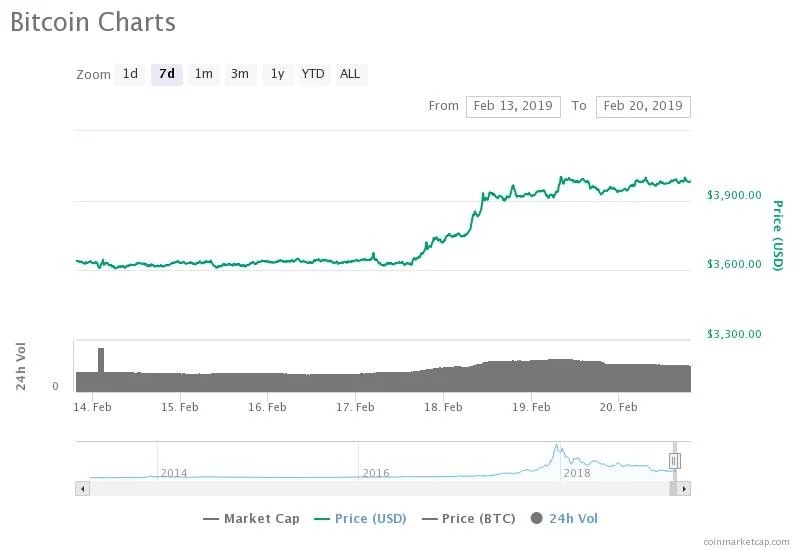

Earlier today, Bitcoin crossed the threshold of $ 4,000, reaching $ 4,010. However, at the time of publication, the leading cryptocurrency is trading below $ 4,000, its value is about $ 3,989. On the BTC weekly chart, it is clear that the week of cryptocurrency began at $ 3,618.

Bitcoin: 7-day schedule. Source: CoinMarketCap

Ethereum is currently trading at $ 148, adding 3% in price. Altcoin grew by 20% compared with $ 123 at the beginning of the week. This month, the ETH grew a little more than 18%.

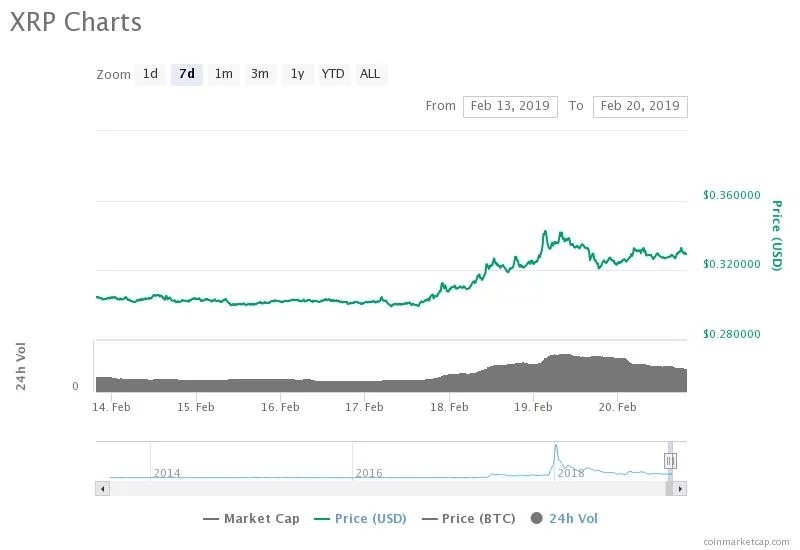

The third largest digital currency by market capitalization, Ripple, gained 1.48% in 24 hours and is trading at $ 0.329. On the weekly chart, XRP increased by 8.10%, while over the month the coin lost 0.3%.

Ripple: 7-day schedule. Source: CoinMarketCap

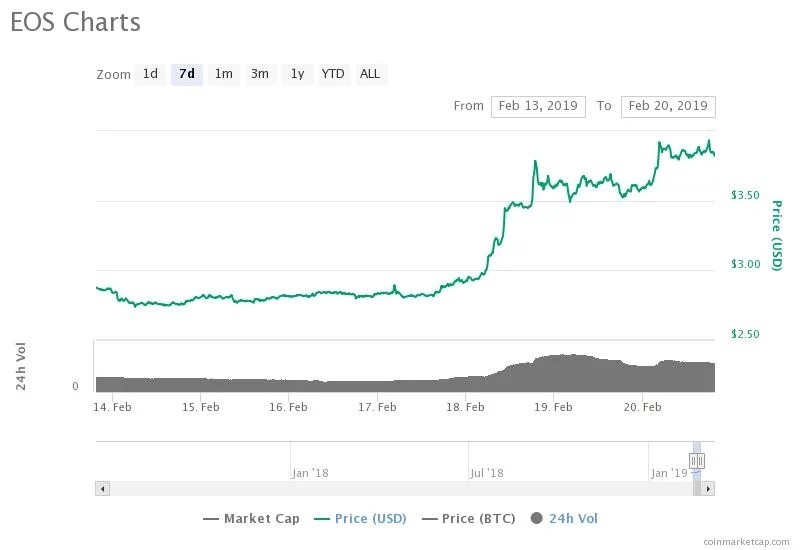

Meanwhile, EOS continues to grow, cryptocurrency has grown by 34% over the week and by 56% over the 30-day period. At the time of publication, EOS increased by 7.76% in the last 24 hours and is trading at $ 3.83.

EOS: 7-day schedule. Source: CoinMarketCap

Among the top 20 digital currencies for market capitalization, only Binance Coin (BNB) and Tether (USDT) reported losses for the past day, decreasing by 0.24% and 0.39%, respectively.

Today BitGo, the institutional level cryptocurrency investment services company, announced that it will provide support for the Tron (TRX) wallet and deposit for cryptocurrency. TRX has not yet responded to the news, rising by only 1.66% per day and is now trading at $ 0.0251.

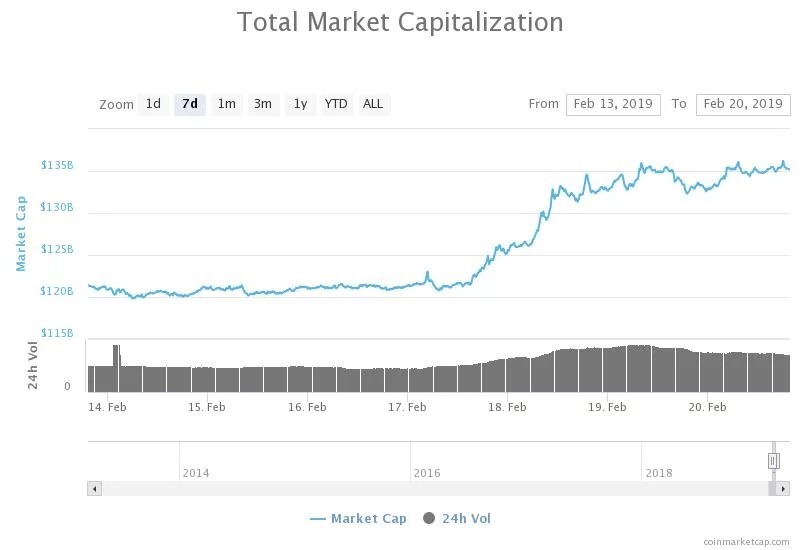

The total market capitalization of all 2074 cryptocurrencies on CoinMarketCap currently stands at about $ 135.4 billion against $ 121.3 billion a week ago.

Total market capitalization: 7-day schedule. Source: CoinMarketCap

In the oil markets, West Texas Intermediate futures reached a new high by 2019, rising 1.5% to $ 56.92 a barrel, while Brent futures rose 63 cents, or 1%, to 67, 08 dollars a barrel.

Andy Lipou, president of Lipow Oil Associates in Houston, said that "the oil market is supported by reductions from OPEC and non-OPEC countries from countries that are determined to see higher prices and supply disruptions."