DeFi platforms are always evolving to provide the best user experience and offer complete services. Next to the financial solutions that bring traditional banking services to the decentralized world, interoperability is becoming a must between platforms. New blockchain projects are looking for solutions to provide cross-chain services. They let users benefit from multiple services by just joining one blockchain at all.

Polkadot has been hosting numerous innovative projects in the past years. Polkastarter is one of the most famous ones. Polkastarter is a decentralized platform for crowdfunding new blockchain projects and building community around them. The blockchain focuses on interoperability and makes it possible to use various tokens in crowdfunding.

What is Polkastarter?

Polkastarter is a solution for interoperability in blockchains. It’s a decentralized launchpad for crowdfunding the new blockchain projects that makes it possible to receive various tokens and build a community around each new project. Polkastarter uses Polkadot as the fundamental blockchain to offer the cross-chain features and combines it with the Ethereum tokens. As a result, crowdfunding on Polkastarter is possible using various tokens and isn’t limited to ERC-20 tokens.

Using Polkadot as the fundamental blockchain makes it possible for Polkastarter users to benefit from fast, cheap transactions. In other words, Polkastarter is here to solve Ethereum’s network congestion problem for crowdfunding and other decentralized use-cases.

Auctions are crucial features in Polkastarter for raising money or even investments. The platform started working with sealed-bid auctions and gradually added other options like Dutch auctions, dynamics, and fixed ration swaps. Polkastarter aims to provide a comprehensive solution for all of the needs in blockchain crowdfunding and DEX needs. Private pools with the feature of protecting them with passwords, whitelisting users, and token swaps that are based on smart contracts, are some of the upcoming features for Polkastarter. Besides, Polkastarter is an open-source platform that offers many benefits for developers. They can implement the Polkastarter core in their project and create specific token auctions.

How Does it Work?

Polkastarter has a fundamental feature that handles the auctions and crowdfunding. Fixed swaps are the answer in Polkastarter for many challenges of crowdfunding for blockchain projects. Fixed swaps are used in Polkastarter DEX to prevent the typical price volatility of tokens. In other words, fixed swaps are different from automated market makers that other DeFi platforms use. Fixed swaps provide better transparency to users and investors and are great solutions for fundraising.

Fixed swaps make it possible in Polkastarter to set a maximum on how much an individual can participate in a project. It prevents dumpings and pumpings from some investors. After all, launching projects and raising funds for them on Polkastarter is more comfortable and safer for development teams. Next to fixed swaps, dynamic swaps are available on Polkastarter that help teams raise funds with more options.

Polkastarter Pools

As mentioned before, Polkastarter provides various features and opportunities for teams to raise funds. There are many types of pools available for them. Private pools are some of the specific types of pools on Polkastarter that bring the opportunity of fundraising from particular people. Password-protected pools provide another feature that brings the full security for private fundraising.

The pools on Polkastarter are known as launchpad pools that provide the crowdfunding feature. They can start an auction for their tokens – mostly initial DEX offerings – and raise money next to building community. SpiderDAO was one of the most successful projects that launched on Polkastarter. MahDAO, Kambria, FIRE Protocol, and Exeedme are other projects that launched their initial offerings on Polkastarter. Most of them experienced a speedy sale of tokens.

The crucial feature in Polkastarter that focuses on the full decentralization of the platform is permissionless listing. Launching fixed swap token pools is available for everyone on Polkastarter. They can use the core framework and launch their own crowdfunding or auctions. But some of the features are limited to those users who hold POLS, the native token of the platform.

POLS the Polkastarter Token

POLS is the native token on Polkastarter with numerous use-cases. It has a total of 100 million supply. POLS holders can benefit from multiple features and opportunities in the platform.

The distribution model for POLS token is designed somehow to maximize the decentralization and incentivize users. According to Polkastarter, the release method for the token is as follows:

- Seed: 20% unlocked before listing, then 10% monthly over 8 months.

- Private: 25% unlocked before listing, then 25% monthly over 3 months

- Liquidity: 22.22% unlocked before listing, then 8.88% monthly over 5 months, then 6.67% monthly over 1 month, then 4.44% monthly over 6 months

- Marketing: 20% unlocked before listing, then 6.67% monthly over 12 months

- Team & Foundational tokens: 1 year fully locked, then 25% quarterly

Use Cases

Governing, staking, and liquidity mining are fundamental use-cases for POLS token on Polkastarter. POLS holders are the governors of the platform. They vote for or against new upgrades, new coin listing, and even the platform’s fee structure.

Staking is a popular and attractive use-case for POLS token that incentivizes users to lock their assets in pools. They receive rewards for staking POLS in various forms. For example, you receive access to a pool by staking enough POLS tokens. The feature makes it possible to limit the investment in pools and only gives access to high-quality liquidity providers. Liquidity mining is the other use-case for POLS tokens that lets you earn money by staking your tokens.

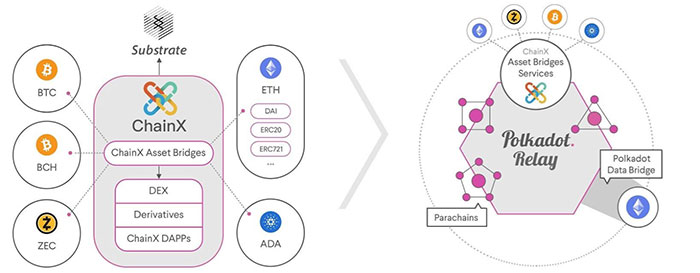

About Polkadot

Polkadot aims to fully decentralize the web. It offers many opportunities for new projects to launch decentralized web platforms. Cross-chain functionality is the primary feature in Polkadot that makes it possible for projects like Polkastarter to launch. Decentralized services, applications, and blockchains can connect easier using Polkadot. The Web3 Foundation supports the Polkadot project with the help of researchers and developers from Inria Paris, ETH Zurich, and Parity Technologies.

Conclusion

Polkastarter is an excellent solution for those who are looking for a decentralized launchpad. Initial offerings are comfortable and secure on the platform. Because of the Polkadot fundamentals, interoperability is a natural feature in Polkastarter, and teams can raise funds using various tokens. With more projects looking for a secure platform to raise funds for their products and more investors looking for safer investments, Polkastarter can experience more growth in the coming years.