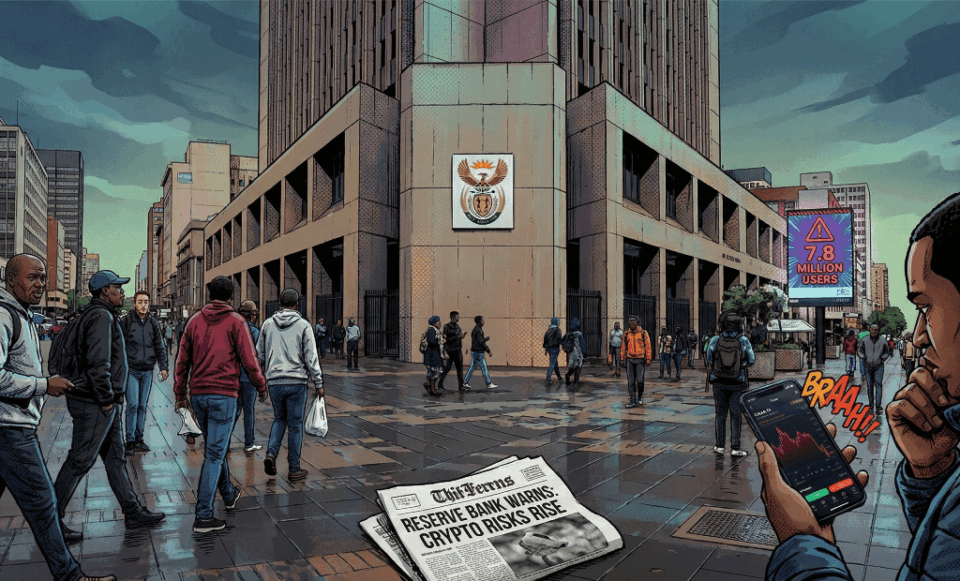

The South African Reserve Bank released its stability report on Tuesday, identifying the financial risks of crypto assets as an emerging threat to the national system. The entity warned that accelerated growth in technological adoption, added to the borderless digital nature, presents complex challenges for maintaining effective control over local capital flows.

According to official data, the combined user base on the country’s three largest exchanges reached 7.8 million in July, holding assets worth 1.5 billion dollars. A significant structural shift was observed, where investors have migrated massively towards dollar-pegged stablecoins instead of Bitcoin, seeking to mitigate inherent market volatility.

Will regulation be able to catch up with the speed of massive digital adoption?

The authorities’ main concern lies in the ability of these assets to circumvent existing Exchange Control Regulations. The G20 Financial Stability Board recently noted that South Africa lacks a framework for global stablecoins, creating an environment where systemic dangers could build up undetected until threatening financial stability.

On the other hand, there is a divergence between the central bank’s cautious stance and the actions of the Financial Sector Conduct Authority. Although licenses have been granted, the lack of specific laws could tighten requirements for providers integrating into the local economy. This could curb institutional innovation if clear rules are not established soon.

Finally, the current scenario suggests imminent pressure to close regulatory gaps and protect the integrity of the monetary system. Regulators are expected to accelerate the implementation of a comprehensive framework, seeking to balance financial security with public demand for efficient digital assets and accessibility in the region, aligning with global standards.