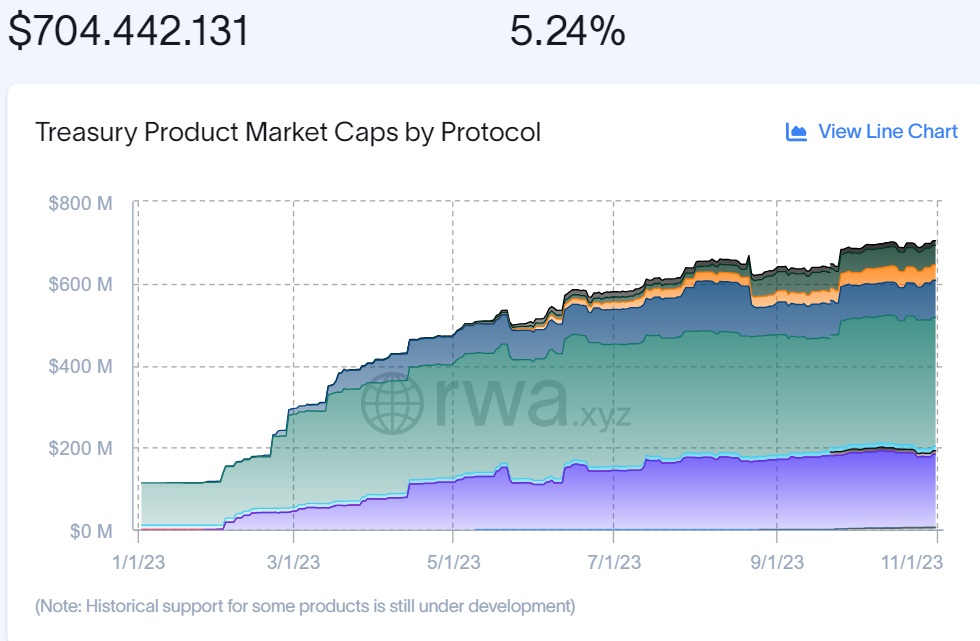

The market for tokenized U.S. Treasury bonds experienced significant growth in the course of 2023. The tokenization of assets has become a continuously expanding trend, and Treasury bonds are no exception.

Tokenized Bonds Diversify

A key factor in this growth is the diversification of the blockchain landscape. Ethereum has surpassed Stellar as the leading blockchain for tokenized government bonds.

Other emerging blockchains such as Polygon and Solana also attracted significant investments, demonstrating a growing competition in the tokenized asset space, with investors exploring various options.

Additionally, there has been a rise in yield-generating stablecoin alternatives. Platforms like Ondo Finance and Mountain Protocol have introduced tokens such as USDY and USDM.

These tokens distinguish themselves from traditional stablecoins like USDT and USDC by allowing users to directly earn yields from the underlying assets.