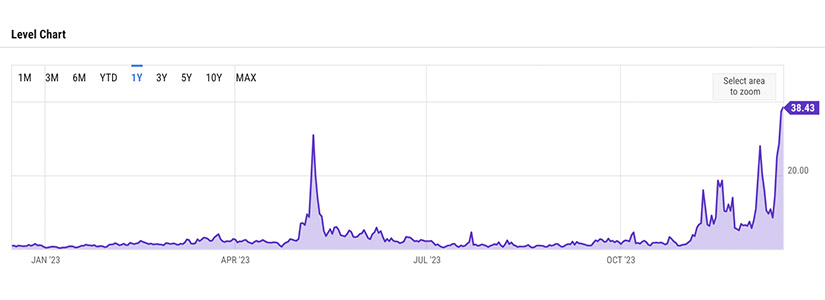

The current frenzy around Bitcoin (BTC) is accompanied by an sharp rise in cryptocurrency transaction fees.

This trend has sparked debates about whether this increase implies an imminent bearish movement for the leading digital currency.

This phenomenon is not new. Historically, significant spikes in Bitcoin transaction fees have preceded downward corrections in its price.

In 2017, just before the market crash, Block rates rose sharply, reflecting an insatiable appetite for the currency which subsequently gave way to an abrupt decline in activity.

Similar events have been recorded in April 2021 and May 2023, where the rise in rates preceded significant falls in value of Bitcoin.

The current price of Bitcoin (BTC) stands at $41,283, showing a decrease of 1.06% in the last day and a drop of 1.12% in the last week.

Despite these recent setbacks, the leading cryptocurrency has seen an increase of 12.45% over the course of the last month, suggesting some volatility in its short-term performance while continuing to show positive growth on the monthly outlook.

However, this pattern in Bitcoin does not guarantee exact repetition.

Some analysts argue that this increase in rates is a positive sign of a vibrant market and growing demand.

This optimism may be driven by fear of missing out (FOMO), suggesting that a sustained rise in prices could still be in play.

Current technical analysis shows critical levels to watch closely. Key resistance lies between $42,000 and $43,000, a region that has been significant in the past.

In addition, the Relative Strength Index (RSI) is below the neutral level of 50, signaling an advantage for the bears.

Despite the warning signs, experts emphasize that this increase in fees is not an absolute guarantee of an imminent drop in the price of Bitcoin.

Traders could carefully consider moves above $43,000 to confirm a potential upside or breakout below $40,200 to signal a structural change in the market.