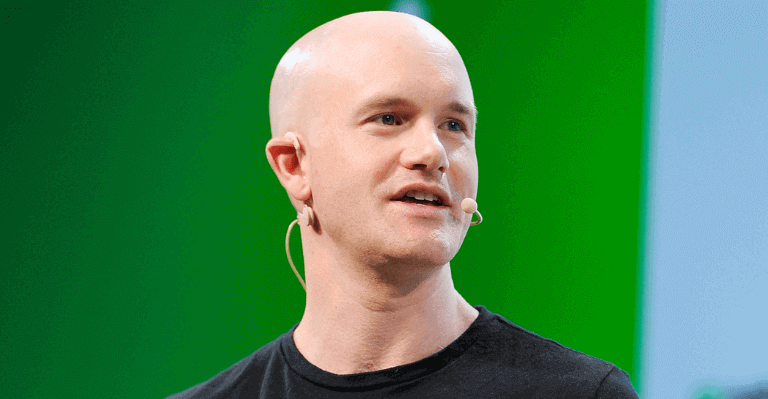

Brian Armstrong, CEO of Coinbase Global, offered an achievable approach for establishing regulatory clarity in the cryptocurrency market in order to restore confidence and turn the page in the aftermath of FTX’s collapse.

Armstrong suggested in a December 19 blog post that regulation should begin with centralized entities, such as stablecoin issuers, exchanges, and custodians, who are the primary sources of consumer risk.

According to him, regulation in traditional finance is structured to ensure that middlemen work fairly and appropriately, and the same idea applies to cryptocurrencies when there are intermediaries.

1/ I often get asked: “What does regulatory clarity actually look like for crypto?” So I outlined a realistic blueprint for this that regulates centralized actors, while preserving decentralized innovation. https://t.co/sYsNR7igVQ

— Brian Armstrong (@brian_armstrong) December 20, 2022

He said that decentralized systems like Defi and DAOs are excluded from that case since they do not use middlemen and that smart contracts and open-source software are the best means of ensuring transparency.

Brian Armstrong Discusses Possible Regulation in Some Crypto Areas

The CEO of Coinbase is of the opinion that a reasonable stablecoin law would require issuers to register as a state trust or OCC national trust charter, invest in high-quality liquid assets, such as US Treasury bonds, undergo thorough annual audits, and set up reasonable controls and board governance, among other requirements.

He also offered some possible rules for custodial crypto exchanges, such as implementing strict “know-your-customer” (KYC) and “anti-money laundering” (AML) policies and procedures.

Moreover, he recommends a federal licensing and registration regime that allows crypto exchanges to get one license and serve an entire country, noting that:

“In places like the U.S., it’s fine to preserve the option for states to issue their own licenses as well, but there should be a federal option that allows the US to be a single market.”

Additionally, crypto exchanges should be obligated to uphold strict consumer protection regulations, including those requiring risk disclosure, fee transparency, and the absence of conflicts of interest, as well as a ban on market manipulation, wash trading, and other nefarious activities.

Mentioning commodities and securities, Brian Armstrong said,

“Perhaps the most complex point that needs clarity is around which crypto assets are commodities and which are securities.”

The CFTC and SEC have been discussing this issue in the United States for some years, but have offered little certainty to the market, as seen by the ongoing SEC vs. Ripple lawsuit.

He believes, however, that Congress must intervene and establish legislation by offering an updated version of the Howey test that applies to crypto tokens that may be classified as investment contracts.

Armstrong said that for the business to be properly regulated, a combined effort by corporations, governments, regulators, and customers from financial markets all around the world—particularly those from G20 countries—will be essential.

Besides, the CEO of the worldwide exchange concluded that the function of financial regulators in cryptocurrencies should be confined to centralized actors since Defi, smart contracts, and Web3 has already equipped consumers with self-custody.