TL;DR

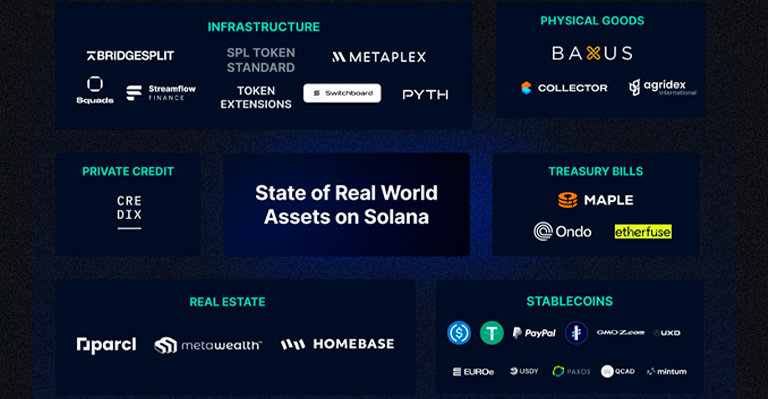

- Asset Tokenization: Solana is expanding its blockchain capabilities to include the tokenization of real-world assets like U.S. Treasuries, real estate, and physical goods, enabling instant and programmable cross-border transactions.

- Bond Platform: Solana Labs has introduced Bond, a platform designed to revolutionize brand loyalty by offering personalized, transparent, and engaging experiences, overcoming the limitations of traditional loyalty programs.

- Future Challenges: Despite the promising advancements, Solana faces challenges such as regulatory compliance, digital contract enforceability, and reliance on external data oracles.

Solana, a high-performance blockchain known for its speed and efficiency, is making significant strides in the realm of Real-World Asset (RWA) tokenization. The platform’s robust ecosystem is now enabling the tokenization of a wide range of assets, from U.S. Treasuries to real estate and physical goods.

Our friends at @reflexivityres have published a comprehensive report about Real World Assets on Solana.

intern's notes 🧵 pic.twitter.com/WRPUC8UOiB

— Solana (@solana) June 11, 2024

This move represents a pivotal shift in how traditional financial assets are managed and traded, offering instant, programmable, cross-border settlements.

Bond: Revolutionizing Customer Engagement

In a parallel development, Solana Labs has launched Bond, a cutting-edge platform aimed at transforming brand loyalty. Bond leverages blockchain technology to create personalized, transparent, and engaging digital experiences.

This platform addresses the limitations of traditional loyalty programs by providing direct engagement with consumers, comprehensive insights into customer behaviors, and ensuring the authenticity of goods through blockchain verification.

Enhancing Liquidity and Accessibility

Solana’s RWA ecosystem is not just about bringing various assets onto the blockchain; it’s about enhancing liquidity and making these assets more accessible. By tokenizing assets like real estate, which are traditionally illiquid, Solana is paving the way for a more inclusive financial system where more people can participate in asset trading.

Personalizing Customer Experiences

Bond’s introduction is set to redefine how brands interact with their customers. By providing tools for personalized communication and curated experiences, Bond empowers brands to foster deeper connections and drive long-term loyalty. The platform’s ability to analyze customer preferences and tailor individual journeys is a game-changer in the customer engagement space.

Future Prospects

As Solana continues to innovate, the potential applications of its technology are vast. The RWA ecosystem could revolutionize the way we think about asset management, while Bond could become a standard for customer loyalty programs. Together, these platforms showcase Solana’s commitment to leveraging blockchain for practical, real-world solutions.

While the tokenization of real-world assets holds immense promise, it is not without its hurdles. The sector must navigate through a complex landscape of regulatory requirements, address the enforceability of digital contracts, and manage the dependency on oracles for external data.

To foster confidence and deter deceptive practices, the establishment of new industry standards and the implementation of impartial third-party audits are essential steps forward.