TL;DR

- Tether (USDT) total supply surpassed $150 billion, driven by steady demand and increased activity in the crypto market.

- Tron overtook Ethereum as the leading network for USDT, holding 48.57% of the supply thanks to lower fees and faster transactions.

- Network efficiency and operational costs are driving volume migration toward Tron, while Ethereum remains constrained by high fees and scalability issues.

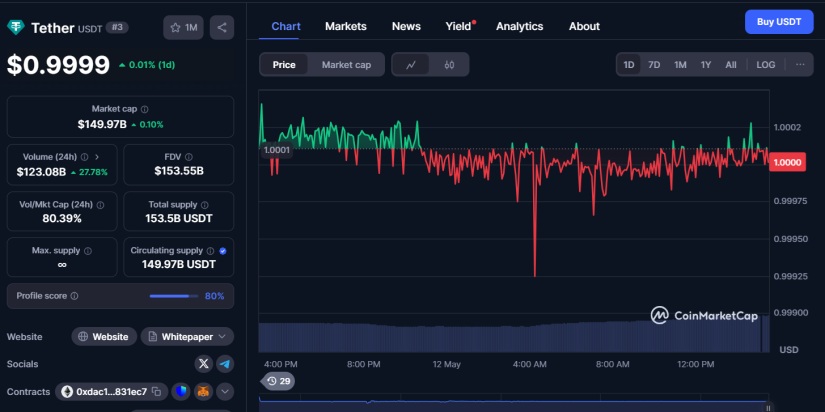

Tether’s (USDT) total circulating supply has exceeded $150 billion, setting a new all-time high for the market’s most widely used stablecoin. This record reflects sustained demand for stable digital assets, fueled by growing activity across the crypto sector and steady adoption in different regions.

Beyond the surge in USDT issuance, the most relevant detail is the shift in the network managing most of its supply. Tron, the blockchain founded by Justin Sun, has overtaken Ethereum as the primary platform for USDT transactions. At present, Tron holds 48.57% of the total supply, equivalent to $73.05 billion, while Ethereum retains a 42.3% share.

This change isn’t surprising when considering the operational differences between the two networks. Tron offers significantly lower transaction fees and faster processing speeds—two decisive factors for stablecoin transfers, particularly in countries with restricted currency markets or limited access to banking infrastructure.

Tether and USDT Choose Faster, Cheaper Networks

Ethereum, although it was the first ecosystem to host stablecoins at scale, continues to face criticism over its high fees and scalability limitations, despite improvements since migrating to a proof-of-stake model.

The remaining USDT supply is distributed across blockchains like Binance Smart Chain, Solana, Avalanche, Polygon, Aptos, and TON, though none of these surpasses a 4% market share. This diversification allows Tether to operate across multiple environments, but it’s clear that network efficiency and operational cost are the key factors determining where the largest volumes settle.

The growth of USDT and the increasing preference for Tron demonstrate how users prioritize speed and minimal fees for daily transactions and cross-border transfers. This trend is likely to continue as long as Ethereum fails to definitively resolve its scalability and cost issues.