In a recent development, the crypto friendly Silicon Valley Bank has collapsed, and the events surrounding it have unraveled rather swiftly. Apart from the temporary depegging of a renowned stablecoin, USDC, regulators were also forced to come up with emergency plans in the UK and the US. These plans revolve around the growing fears of small businesses, and depositors stuck at the Silicon Valley Bank.

A Timeline of the Events

The chain of events regarding the Silicon Valley Bank have been summarized as follows:

- March 10: The Silicon Valley Bank closed its doors following the revelations of California’s financial watchdog. It was done after the announcement of the significant sale of assets and stocks. Furthermore, the exact reason for the bank’s shutdown wasn’t stated. The results of the bank’s collapse spread like fire not long after the management stated that the bank needed $2.25 billion in stock to keep the operations going. At the same time the stock price of the Silicon Valley Bank dipped by a staggering 60%. The Bank of England stated that SVB UK would halt making payments and accepting deposits.

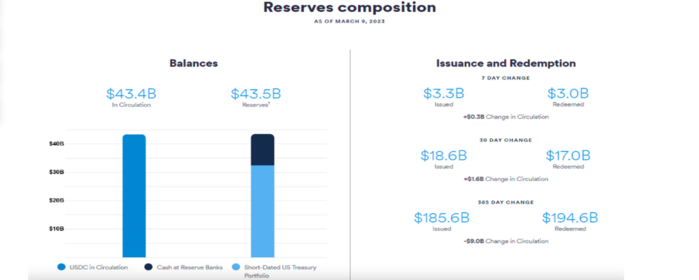

- March 11: The effects of the collapse of the Silicon Valley Bank were injected in the crypto market. The renowned crypto firm, Circle stated that it has approximately $3.3 billion in SVB. The firm’s USDC stablecoin was then subject to a decline of 10% in value. The event led to a domino effect that knocked multiple stablecoins from their pegs, reminding everyone of the Terra incident. As a result, jolts were felt throughout the DeFi community. The whales seek to transfer funds away from USDC, and DAO issued an emergency proposal to mitigate $3.1 billion exposure to USDC. Similarly, Curve Finance witnessed record-breaking transactions of $7 billion the same day.

- March 12: The US Treasury announced that it focused on the needs of the depositors, and would not bail out the bank. At the same time, Rishi Sunak mentioned how there were plans to ensure short-term operational and cash flow needs of SVB UK customers.

USDC Regains $1 Following the Silicon Valley Bank Fiasco

During the peak of the previous events, the USDC stablecoin, fell to its all time low of 81 cents. However, the decline didn’t last long as the stablecoin started to recover soon. Apart from Circle’s announcement, another factor that led to the decline was Binance and Coinbase suspending USDC conversions.

The situation has now changed as USDC has reclimbed to the $0.99 mark. The CEO of Circle appreciated the efforts of the FED regarding the $25B funding program. It was stated that the entirety of the USDC reserves were secure. Similarly, the firm mentioned that it now has new banking partners, and operations would resume soon.

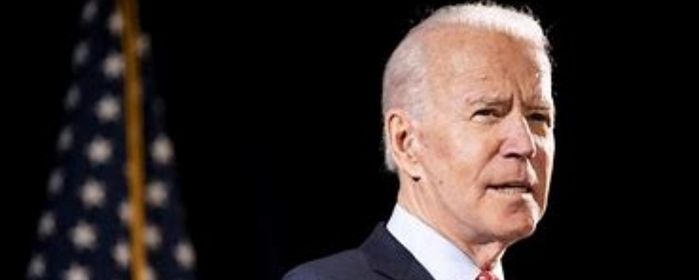

Biden Promises to Ensure Accountability

In another news, the NYDFS took control of the Signature bank. The FED mentioned that the bank was closed to protect the economy and strengthen public confidence in the banking sector. The US president, Joe Biden expressed his plans of holding the ones accountable for the collapse of Signature and Silicon Valley banks. He added,

“I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again.”

He appreciated the authorities over reaching a solution of protection for workers, small business owners, and so on. Also, he will keep a check and stay updated on the developments in this case.