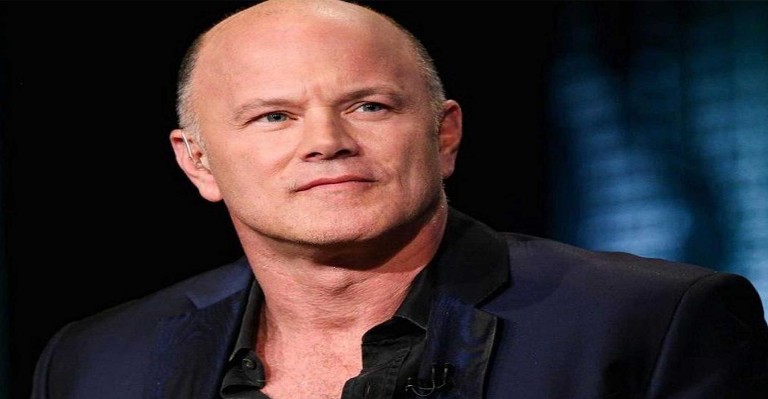

Hours after the United States Congress failed to reach a bipartisan agreement on a proposed $2 trillion economic support package, Galaxy Digital founder Mike Novogratz wrote in a tweet:

“$BTC will continue to be volatile over the next few months but the macro backdrop is WHY it was created. This will be and needs to be BTC’s year.”

Recently, conventional markets had endured their most exceedingly terrible blows since 1987 — a dive reflected in Bitcoin’s 60% drop to lows of around $3,600 on certain trades.

As the pandemic enters its fifth week — exacerbated by crumbling request and a value war in the oil segment — frightened financial specialists have proceeded with their sell-offs medium-term.

Asian stocks have drooped in the aftermath from the impasse in Congress, with Wall Street prospects colliding with hit their drawback breaking point of 5%.

Ten days prior — with speculators forsaking even “place of refuge” wares, for example, gold — Novogratz contended that Bitcoin was no less powerless against the effect of the rushed liquidations:

“[Bitcoin] was always a confidence game. All crypto is. And it appears global confidence in just about anything has evaporated.”

However his most recent tweet presently focuses to the potential open doors for the cryptographic money in the midst of the monetary emergency.

Right now, — as an oversight safe vehicle of trade and non-inflationary unit of record — was planned definitely as an option in contrast to the vacillating scene money related framework.

In a tweet that followed his comments on Bitcoin yesterday, Novogratz had engaged a slowing down Congress not to rehash the “main disappointment of TARP” — the dubious bailout finance went in 2008, which some consider to have left the auxiliary shortcomings of the framework for all intents and purposes flawless.

Observing Bitcoin’s obvious decoupling from COVID-stricken conventional markets prior this week, Changpeng Zhao — the CEO of crypto trade Binance — had correspondingly contended that the pandemic ought to be comprehended as a trigger, as opposed to the underlying driver, of a noticeably delicate world monetary request.