Investing in Russia is gaining popularity at a very slow pace, but increasingly, the young people can hear the intention in creating multiple sources of passive income or the desire to invest. To protect the interests of investors is an important aspect of investment activity. From financial literacy, economic education, but most of the regulation instruments for the protection of investors depends largely on the attitude of society, in particular young people, to investment activities.

Study the problem first and foremost related to the level of public awareness about legal ways to protect their investments. In this regard, this article aims to identify the most protected and unprotected assets for investment.

The relevance of the research topic due to the need to explore ways of protecting investors who operate in Russia today in order to build imagining a safe investment and the desire to become investors.

In the first place you should turn to theoretical and normative-legal bases of Institute of the investment. Article 1 of the Federal law “On investment activity in the Russian Federation implemented in the form of capital investments” of 25.02.1999 N 39-FZ establishes the following definition of investments and investment activities:

“Investment — cash, securities, other property, including property rights, other rights having monetary value invested in objects of entrepreneurial and (or) other activities for profit and (or) achievements of other useful effect”.

“Investment activity — investments and implementation of practical actions in order to make a profit and (or) achievements of other useful effect”.

In this regard, it is also necessary to give a definition of investment protection.

Investment protection is provided by law a number of legal, technical, organizational and legal actions aimed at ensuring conditions conducive to the safety of the investment and guarantees of investment protection and investor’s rights on investment and obtaining a legitimate profit.

Not do in matters related to the study of investment activity, without data.

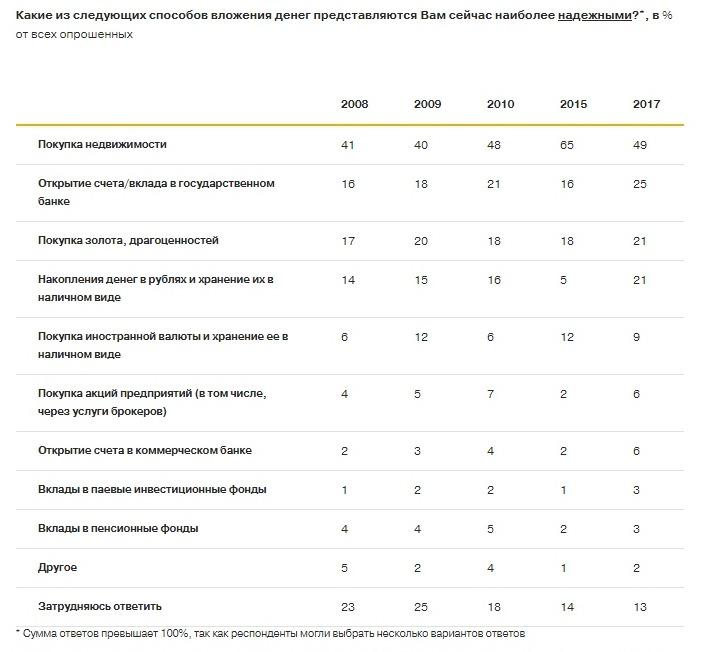

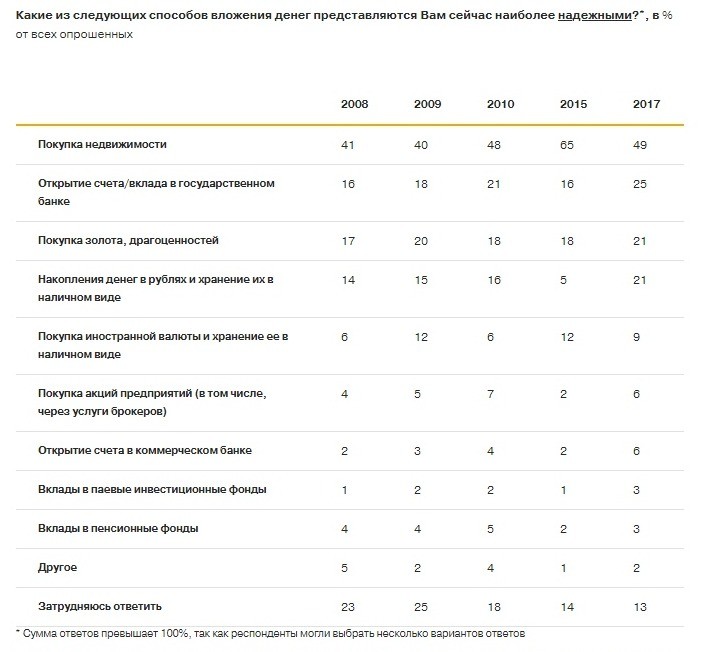

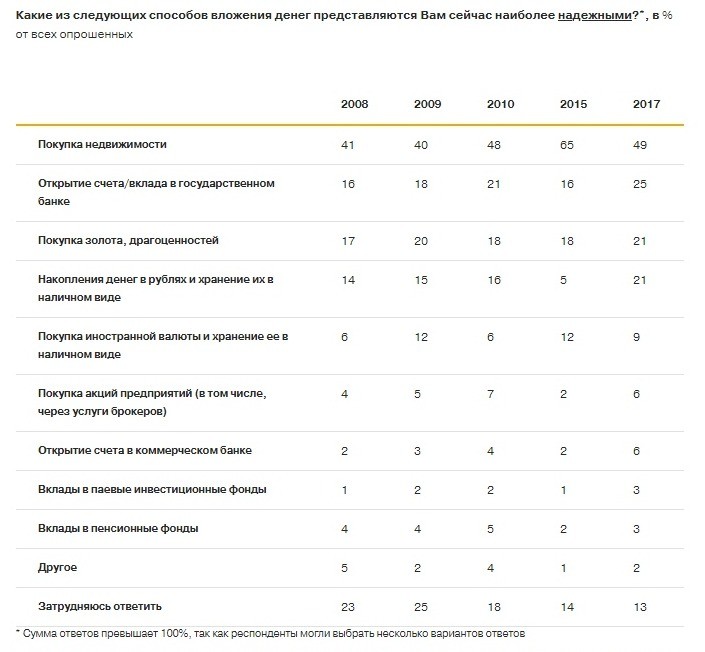

The national Agency for financial studies provides data for 2008, according to which only 5% of Russians were ready to invest their funds in financial instruments, and two-thirds of respondents said they can trust their money only to banks. Statistics say that ten years ago the citizens of our country have been popular only three ways of investing:

- the purchase of the property;

- buying gold, jewelry;

- opening a Bank account.

Over the past 10 years, the situation in our country practically has not changed. The above assets are still the most popular. Statisticsgathered by the experts NAFI, shows this clearly.

You should understand the reasons why other methods of investing are not gaining popularity? In our opinion, the answer lies in low wages, financial illiteracy, the tendency to use conservative and safe ways to accumulate cash. Together these reasons in varying degrees affect the Russians in the matter of investment, and this explains why the most stable assets in our country are still real estate and Bank deposits.

“As noted in the national study of experts, the purchase of real estate continues to be perceived by his compatriots as the most reliable method of investing money, although in 2015 the share of trusting square meters and falls (65% in 2015 and 49% in 2017). However, over the past two years, according to the Russians, several times increased the reliability of the accumulation of money in roubles and their storage in a cash kind (from 5% to 21%). The interest of the citizens to their savings in foreign currency at the same time, as noted in NAFI, remains approximately at the same level (12% in 2015 and 9% in 2017)”.

As mentioned earlier, the level of financial literacy of the population also has an impact on the investment activity of the population. A study of the Ministry of Finance of Russia from 19.07.2017, the purpose of which was to measure the level of financial literacy in Russia, allowed to enter into the growth of financial literacy of the population by a few points compared to 2013, however the study in 2017 of the G20, conducted by NAFI, identified for Russia increased 12.2 points from 21 (the average for the G20 to 12.7). This suggests a very low increase in the level of financial literacy in the country. And in this case the results of the study NAFI more revealing and true.

Why Russians do not know enough about Finance? Kovalchuk A. V. in his article “assessment of the level of financial literacy in Russia” identifies the following reasons:

- The underdevelopment of the financial services market in the USSR.

- Limited understanding of Finance and financial services to the citizens of the USSR.

- The crisis of 90-ies, the development of financial fraud.

- Features of Russian mentality: a large number of the population imposes unreasonably high hopes for state assistance.

- Low income population.

- The structure of income and expenditure.

- Periodic crises in the economy.

- Historically the trust to foreign currency.

- The ignorance of the adult generation in Finance not allows to transmit knowledge to the younger generations.

All this confirms the existence of the problem and, as a consequence, leads to the fact that the majority of people (89%) do not know about the methods of fraud protection in the financial sector exist at the moment. However, the gradual increase in literacy level will help to resolve this issue. To act in this area is necessary for both the state and the population, but self-development and self-education in the field of Economics is, in our view, the most effective method of obtaining basic knowledge on investments and personal Finance.

In our study we need also to examine the direction of investment from the point of view of the prospect and determine the degree of protection from the point of view of the legislation.

Among the promising areas for investment in 2019 release:

- Real estate.

- PAMM account — specific mechanisms of the trading account, technically simplifies the process of transferring funds on the trading account in trust to the Trustee selected for operations on the financial markets.

- Startups.

- IPOs, or securities is the first public offering of shares of the company, also called emission. The company first issues its stock to the market and buys them a wide range of investors.

- Cryptocurrency — a kind of digital currency, the creation and control of which are based on cryptographic methods.

- Banks.

- Popular projects network marketing.

- Precious metals.

- Crowdfunding project (e.g. Kickstarter). Crowdfunding — the collective cooperation of people who voluntarily pool their money or other resources together, usually via the Internet, to support efforts by other people or organizations.

The degree of protection of each of these types of assets varies. It primarily depends on the availability of legislative base regulating this sphere because it means the recognition of the asset as an object of legal regulation in the state. This determines the degree of riskiness of investments in a particular asset. Consider each of the above assets subject to security below.

For the analysis of instruments of investment protection, the study was considered protected and unprotected modes of investment. The data are given in Table 1.

It should be noted that where promised high returns, it is always about high risk, so it is logical that the state is not in all cases ready to provide protection to investors. The most risky investors are responsible for their own choices.

| Protected asset | Security | Unprotected asset | The reasons for the lack of security |

| Real estate | The Federal law “About participation in share building of apartment houses and other real estate and on amendments to certain legislative acts of the Russian Federation” dated 30.12.2004 N 214-FZ Federal law “On investment activity in the Russian Federation implemented in the form of capital investments” of 25.02.1999 N 39-FZ | Cryptocurrency | Completely unprotected asset, in the absence of legislation regulating this sphere. At the moment, cryptocurrencies are not recognized in Russia at the legislative level, in accordance with what is not defined class of assets to which they relate. Therefore, investing in crypto currencies today is not government insured. However, the authorities have started the development of legislation in this area in 2017. |

| Bank deposits | The civil code of the Russian Federation The Federal law “About insurance of contributions of physical persons in banks of the Russian Federation” dated 23.12.2003 N 177-FZ | Pop projects, network marketing | Today, the Federal law governing network marketing or deposits in startup projects are still there. |

| IPOs, or securities | Federal law of March 5, 1999 N 46-FZ “On protection of rights and legitimate interests of investors on the securities market” Federal law “On securities market” dated 22.04.1996 N 39-FZ | Crowdfunding projects | Investors putting money into crowdfunding, this time also not protected. The drafting of a law regulating this sphere began only in late 2017/early 2018. To date, the bill is being finalized. |

| Precious metals, CBOs | The civil code of the Russian Federation The Federal law from 26.03.98 № 41-FZ “On precious metals and precious stones” Resolution of the Government of the Russian Federation from 30.06.94 № 756 “On approval of the Regulations on transactions with precious metals in territory of the Russian Federation” | ||

| The foreign exchange market | Federal law “On currency regulation and currency control” of 10.12.2003 N 173-FZ |

(Table 1. “Classification of investment criteria — security”)

So, we developed classification of investments on the basis of security, it follows that the existence of legislative regulation of the industry is one of the most important indicators of investment safety. Legislative protection allows investors to reduce risk by investing in various sectors of the economy, and hence gain confidence in the entities or intermediaries that are involved in this process (banks, mutual Funds, issuers of securities, etc.).

Thus, for experienced and novice investors one of the most important factors in the choice of investment should be not only the degree of profitability, but legislation regulating this sphere. The recognition of assets by the government and legislative consolidation of rules for their treatment is the guarantor of protection in the event of unforeseen circumstances or fraud. That is why most experienced investors are recommended to diversify your investment portfolio and the savings to invest not only in innovation (for example, cryptocurrencies) and developing (crowdfunding) projects or assets, but also in traditional markets. This method allows to reduce the risk of losing money due to fraud and enables investors to understand the system of regulation of a particular sphere. However, the majority of the Russian population is not interested in the topic, and so many of us have a high risk of loss.

To solve the problem of public awareness about legal ways to protect their investment and Wake the interest of the citizens to develop their financial literacy we offer the following solutions.

- Permanent informing the population about the security of a particular investment environment. The communication with the public authorities on this topic should be more informative. The message: “don’t invest in crypto currencies because they are not regulated by anyone, and market volatility is at a high level!” will only reduce people’s confidence to invest and the desire to explore areas of the economy. This can be reformulated in the following way: “do Not invest in crypto-currencies, pay attention to traditional markets, find out more information about investments in securities, increase your income through the legally regulated assets! This will allow you to minimize the risk of loss of your money”. You need to offer an alternative and explain in detail all the details.

- To create a public knowledge base on the Internet for independent learning and to promote their various information channels (media, social networks, radio, etc.).

- To include courses on Economics and investing in schools, colleges, universities, courses for professional development.

- Use the experience of other countries to improve financial literacy.

In our opinion, the above measures should help not only to increase legal literacy of the population, but also to intensify the interest of people to invest and legitimate ways to generate passive income. This will have a positive impact on the development of each individual personality, and the Russian economy as a whole.

References:

- The Russians are afraid to invest (date accessed: 20.12.2018).

- The Russians are willing to keep their savings in rubles (accessed: 20.12.2018).

- Assessment of the level of financial literacy (accessed: 20.12.2018).

- Kovalchuk A.V. Saybel N. Y. assessment of the level of financial literacy of the population in Russia// Scientific-methodical electronic journal “Concept”. – 2018. – No. 1 (January). – 0,4 p. L.

- Where to invest money in 2019: promising areas for investment (date accessed: 20.12.2018).

- NAFI: Russians prefer to invest in real estate and believe in the ruble (accessed: 20.12.2018).

- Problematic issues of legal regulation of network marketing (date accessed: 20.12.2018).

- Russian crowdfunding. Projects regulation of crowdfunding activities (date accessed: 20.12.2018).

- The draft Federal law “On digital of financial assets” (date accessed: 20.12.2018).

- As the bills of the Central Bank and the MAYOR can influence the market of crowdfunding (date accessed: 20.12.2018).

- About the official government review of the bill on alternative ways of attracting investment (crowdfunding) (date of access: 20.12.2018).

- Consideration of the draft law “On digital of financial assets” moved to spring 2019 (date accessed: 20.12.2018).

- Protection of investments (date accessed: 20.12.2018).

- Legal aspects of Unallocated bullion accounts (date accessed: 20.12.2018).

- Russia occupies the 25th place in terms of financial literacy around the world (date accessed: 20.12.2018).

Authors:

Varaksina, A. O. — the 4th year student of UIU Ranepa faculty “State and municipal management”.

Kistanova A. A. — 4th year student of UIU Ranepa faculty “State and municipal management”.

Shcherba N. A. — 4th year student of UIU Ranepa faculty “State and municipal management”.