TL;DR

- Large amounts of Ethereum (ETH) linked to the PlusToken Ponzi scheme, around 2,800 ETH, have been transferred from inactive wallets to a single wallet.

- PlusToken, dismantled in 2020, resulted in the seizure of nearly $4 billion in tokens, including ETH, BTC, DOGE, and XRP, with 27 people arrested and over 2 million investors affected.

- Speculation suggests that up to 789,533 ETH could be sold, which could significantly impact the cryptocurrency market.

Recent movements of large amounts of Ethereum (ETH) linked to the PlusToken Ponzi scheme have raised alarms in the community. The funds amount to approximately 2,800 ETH. They have been transferred from several previously inactive wallets to a single wallet, sparking concerns about potential market sell pressure.

PlusToken, a Ponzi scheme dismantled in 2020, resulted in a massive seizure by Chinese authorities. In November of that year, nearly $4 billion worth of tokens, including Ethereum (ETH), Bitcoin (BTC), Dogecoin (DOGE), and XRP (XRP), were confiscated. The operation also led to the arrest of 27 individuals associated with the scheme and exposed the scale of the fraud that had defrauded over 2 million investors.

Can PlusToken Hit the Market?

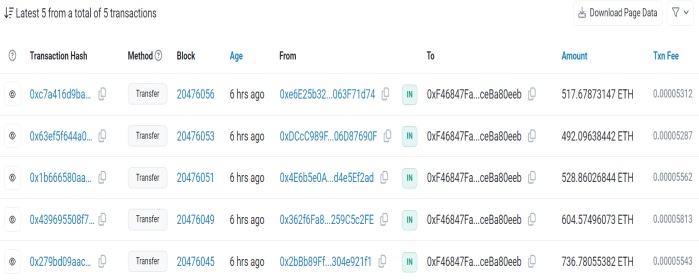

The recent movement of funds has been traced to a wallet that was part of the 2020 seizure. These wallets had been inactive for approximately 3.3 years. According to on-chain data, these transfers, totaling more than 2,800 ETH, have been consolidated into a specific wallet identified as “0xf46847fa42fd9dd52737f3d25b8659cceba80eeb.” Speculation has begun about the possibility of a massive sell-off that could affect the prices of associated cryptocurrencies.

Market concerns arise due to the magnitude of the funds involved. On-chain tracking firm LookonChain has reported that up to 789,533 ETH, equivalent to approximately $2 billion, could be moving. This massive volume could have significant implications for cryptocurrency prices if the funds are liquidated in the market.

The situation is being closely monitored by the crypto community and investors. Who fear that the movement of these funds could exert uncontrollable sell pressure, igniting volatility in the prices. The community is on alert as further movements are anticipated.